AUTRALIAN DOLLAR FORECAST: NEUTRAL

- The Australian Dollar has been pummelled in a frantic week of hikes

- First the RBA, then the Fed tightened policy by more to underpin USD

- Despite a sound fundamental backdrop AUD remains under pressure

The Australian Dollar whipsawed over the week after rate decisions from the RBA and the Federal Reserve ricocheted through markets. AUD/USD saw daily moves of more than 2% in opposite directions on Wednesday and Thursday.

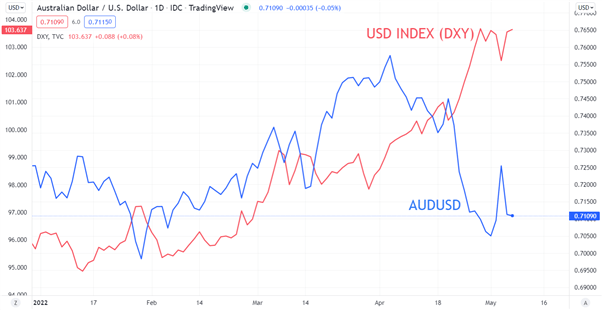

The clear message for the Aussie Dollar is that it remains at the whim of US Dollar gyrations.

The underlying fundamental position of the Australian economy remains strong. Public and private debt is at relatively comfortable levels. The trade balance (AUD +9.3 billion) released this week highlighted the strength of exports. Unemployment is at generational lows (4%) and growth remains robust.

None of this means anything for AUD/USD as the US Dollar comes to grips with a Fed that is finally tightening monetary policy at break-neck speed to reign in eye watering inflation.

While the RBA hiked by 25 basis points (bp) on Tuesday, as predicted in this column over a month ago, the Fed raised the stakes by 50 bp on Wednesday.

Fed Chair Jerome Powell effectively ruled out futures hikes of 75 bp and this saw USD weaken as the market had hopes of such moves.

The Dollar then did a U-turn the next day after former Vice Chair Richard Clarida appeared to get back on the super hawk track when he said, “Expeditiously getting to neutral will not be enough.” AUD/USD was caught up in the maelstrom.

Going into the weekend, USD/CNY was allowed to weaken to its lowest level since November 2020 and this could have ramifications for broader currency markets. If the currency of the world’s second largest economy continues to weaken against the USD, Dollar strength could become even more broad based.

This puts AUD/USD in a precarious position as it trades near 18-month lows. All eyes will be on Fed speakers in the week ahead. Any push in hawkish rhetoric could see another surge is US Dollar strength that may expose AUD to the downside.

The chart below highlights the vulnerability of the Aussie to US Dollar moves.

AUD/USD AGAINST US DOLLAR INDEX (DXY)

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter