AUSTRALIAN DOLLAR FORECAST: BULLISH

- The Australian Dollar refuses to lie down as growth sentiment sways

- The spread of new Covid variants weigh, but green shoots might be appearing

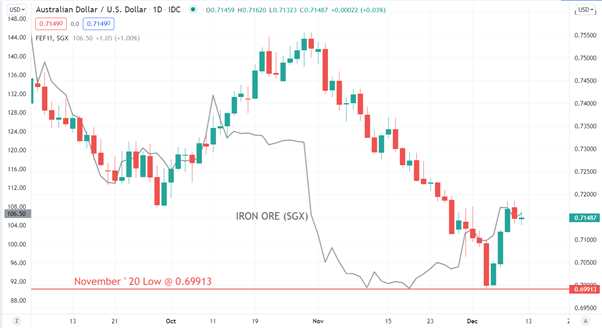

- Iron ore and commodity markets appear to be recalibrating. Will AUD/USD rise?

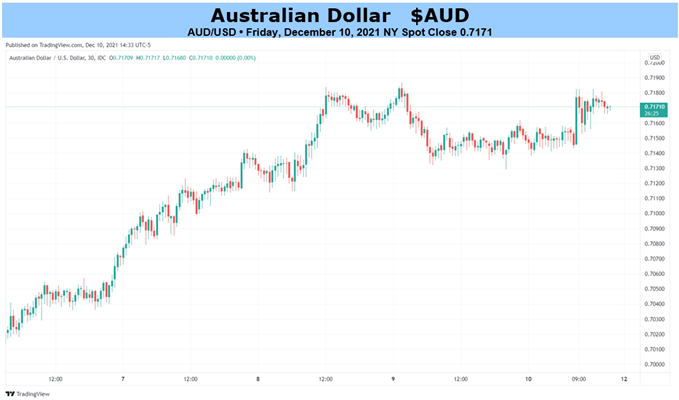

The Australian Dollar finished last week testing the November 2020 lows of 0.69913. This week it has bounced back as positive risk sentiment returned. It also appears that some positioning unwinding may have occurred after the RBA meeting on Tuesday.

The spread of the Omicron variant of Covid-19 had been weighing on markets due to the uncertainty of how transmissible it is and the impact on human health compared to previous strains.

Early indications appear to point toward a highly transmissible strain that may not lead to as many hospitalisations as previous variants. This perspective is yet to be verified.

In any case, market reaction has been that of less concern for the economic impacts than it had been previously.

The RBA left monetary policy unchanged on Tuesday as expected. The tone in the post meeting statement reflected patience on the board’s behalf, as the bank does not face the same inflationary pressures that many other central banks are experiencing.

This leaves the RBA with scope to maintain their current monetary policy stance until their next meeting in February 2022.

The market had been expecting this relatively dovish stance and it appears that it may have been caught short. The latest CFTC data shows speculative positions in AUD/USD to be skewed this way.

There was also some growth positive news from China as the PBOC cut the reserve ratio requirement (RRR) for banks by 50 basis points. This has seen the iron ore price edge up this week.

A key driver of AUD/USD is the US Dollar and next week there will the Federal Open Market Committee meeting (FOMC). This has the potential to be significant market mover for the Aussie.

Since the last FOMC, the Fed has turned remarkedly hawkish in their commentary. There are high expectations for an acceleration in the pace of tapering and for rate hikes in the US next year. Should expectations not be met, volatility might increase again.

Looking ahead for the Aussie, next week will see business and consumer confidence numbers early in the week before the unemployment data on Thursday.

AUD/USD AND IRON ORE (SGX)

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter