Australian Dollar Fundamental Forecast: Bearish

- Australian Dollar declines despite broad strength in stock markets

- Weaker iron ore, copper prices could keep working against AUD

- RBA may further hint at rolling yield target to November 2024 bond

The sentiment-linked Australian Dollar fell this past week against its major counterparts, struggling to capitalize on a rosy week for global stock markets. This is despite material gains in Chinese benchmark stock indices, where the Shanghai Composite climbed 3.28%. The Aussie Dollar can at times behave as the markets’ key liquid China proxy due to Australia’s raw material exports to the world’s second-largest economy.

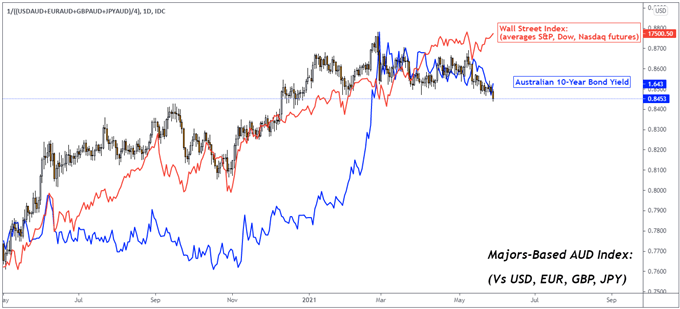

Weakness in the Aussie may have been for a couple of reasons. The first is the drop in iron ore prices, with the Dalian Commodity Exchange (DCE) futures contract down over 17% from the May 12th peak. The second could be due to a decline in Australian 10-year government bond yields, signaling that the markets may be pricing in a slightly more dovish RBA. This may be due to another temporary lockdown in Melbourne.

China, the world’s largest consumer of iron ore, has been attempting to curb steel output in an effort to reduce pollution. On top of this, the nation is trying to temper speculative asset bubbles. Whether or not the latter may prevail remains to be seen, but these efforts could cool the boom in metals like copper as well. That may continue working against the Australian Dollar’s favor.

The Reserve Bank of Australia is on top in the coming week. No changes in policy are expected, with benchmark lending rates and the 3-year bond yield target both anticipated to remain at 0.10%. But, the central bank may reinforce that it could roll the bond target to the November 2024 bond at their July meeting. That may uphold the notion that policy tapering may come later-than-expected.

This would also follow a fairly disappointing local jobs report for April, where Australia unexpectedly lost about 30,000 positions. The markets will also be tuning in to the next US employment report, due on Friday. Another solid beat for wage data may revive sooner-than-expected tapering expectations, opening the door to weakness in global equities. All things considered, it could be another disappointing week for AUD.

Australian Dollar Index Versus Wall Street and AU 10-Year Government Bond Yield

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter