Australian Dollar Fundamental Forecast: Bullish

- Australian Dollar gains as US Dollar and Treasury yields weaken

- Dovish Fed commentary poured cold water on rate hike expectations

- Relatively quiet week may keep this momentum going for time being

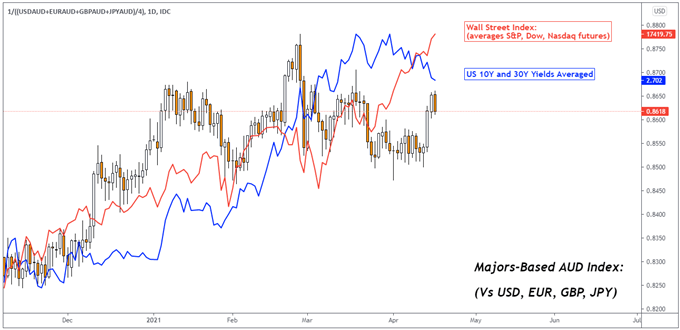

The sentiment-linked Australian Dollar aimed cautiously higher this past week, but it remains lower than where it was on average against its major counterparts in February – see chart below. On the whole, the Aussie has been in a fairly consolidative state since the end of 2020, materially slowing down its upside progress since last year’s Covid-induced bottom.

Now, fundamental forces could continue to support the Aussie in the near term, but it remains to be seen if it could have a material lasting impact. This past week, the Aussie capitalized on a decline in Treasury yields despite higher-than-estimated US inflation and retail sales data. In fact, headline CPI clocked in at 2.6% y/y in March, the most since August 2018.

But, ongoing dovish commentary from the Fed and insistence on higher inflation being a transitory effect meant that hawkish expectations have been materially cooling. Odds of one hike by the end of next year sit at around a 50-50 split now, down from roughly 90% confidence at the beginning of April. This opened the door for global equities regaining upside momentum as the US Dollar drifted lower.

Hence, the focus for the Aussie likely remains on external event risk. Last week’s Australian jobs report was fairly rosy, aside from a decline in full-time positions. But, much like the Fed, the Reserve Bank of Australia (RBA) will likely maintain an accommodative stance. Key local event risk to watch for in the week ahead include RBA minutes and local retail sales figures.

US first-quarter earnings season remains in play. Notable releases ahead include those from Honeywell, Intel and Netflix. On the whole, earnings’ surprises have been fairly rosy so far, opening the door to more beats ahead. US Markit Manufacturing PMI is also on tap. But, a relatively quiet week of economic event risk may open the door for bond yields to keep cooling, leaving a favorable environment for stocks and the Aussie.

Australian Dollar Index Versus US Stocks and Treasury Yields – Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter