EURO, EUR/USD, US Dollar, China, AUD/USD, NOK - Talking Points

- The Euro strengthening is largely a function of USD weakness for now

- APAC equities followed the lead from the US with significant losses

- Stocks and the US Dollar are in the cross hairs.Will EUR/ USD reverse?

The Euro has continued to rally as the US Dollar remains under pressure. Dollar weakness continues as the market appears content that it has priced in the Fed’s hiking timeline appropriately.

APAC equities suffered significant losses today, following on from the Wall Street lead. The Nasdaq collapsed 2.51% in the cash session as the reality of higher interest rates is starting to be realised.

Futures markets are so far showing a steady start for the North American bourses when they re-open today.

Federal Reserve Governor Christopher Waller spoke to Bloomberg after the US close. He re-iterated much of what is already know about the Fed’s intentions.

Waller agreed to a March meeting rate lift-off, but ruled out a 50 basis point hike for the foreseeable future. He said that while officials will look at long-end yields for impact, the Fed Funds policy rate remains their main tool.

President Joe Biden appointed Sarah Bloom Raskin to run the Federal Reserve’s regulatory division. She is viewed by commentators to be an advocate for tighter banking controls.

In geopolitical news, it’s being reported that the US is putting pressure on its European allies to look at placing potential sanctions on Russia. There is growing concern that the Kazakhstan incident – where Russian troops were deployed to help contain a broad-based uprising against the Kremlin-friendly government – might be a precursor to action in the Ukraine.

Chinese trade data, released on Friday, showed imports were down but exports were surging through December to record a better expected trade surplus of USD 94.46 billion instead of USD 73.95 anticipated. AUD/USD was slightly firmer on the news.

All other G-10 currency pairs have rallied against USD in the Asian session today, with the Norwegian Krone being the best performer. High crude oil prices continue to underpin it.

Looking ahead, ECB President Christine Lagarde will be speaking at the same time that US retail sales numbers will be released.

EUR/USD Technical Analysis

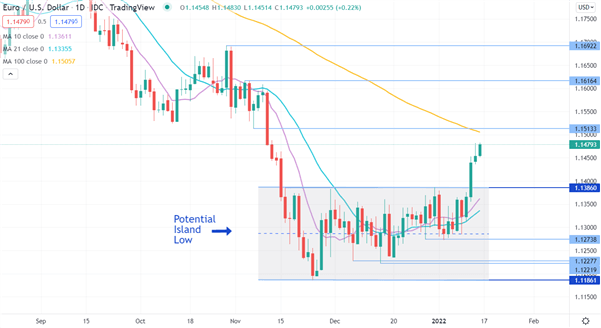

EUR/USD has moved up significantly in the last few sessions. The clean break above the previous resistance level at 1.13860 may have created an island low.

This formation could potentially signal a reversal. It should be noted though that past performance is not indicative of future results.

The 10- and 21-day simple moving averages (SMA) are currently below the price and have positive gradients. This might indicate short term bullish momentum in unfolding.

However, the long term 100-day SMA remains above the price with a negative gradient and could a resistance level. Further up, a pivot point at 1.15133 and previous highs at 1.16164 and 1.16922 are potential resistance levels.

On the downside, the pivot points and previous lows at 1.13860, 1.12738, 1.12277, 1.12219 and 1.11861 might provide support.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

.jpg)