S&P ASX 200, Hang Seng, China,AUD/USD, AUD/JPY, Iron Ore, ECB - Talking Points

- Asian equities were lower after the cautious lead from the US overnight

- Risk-off continued into bonds being bought and commodity currencies lower

- Ahead, ECB language may have more implications for risk appetite

Asian equities followed on from the US lead and drifted lower today with the S&P ASX 200 and the Hang Seng Index (HSI) hit harder than other indices. The Nikkei 225 also ended an 8-day winning streak. Australian equities were led lower by the miners and banking stocks while the Chinese government’s continued crackdown on gaming tech companies weighed on investor sentiment.

The aftermath of the Fed’s Beige Book economic outlook lead to caution across asset classes in a classic risk-off day, with equities up and bonds down. Australian and New Zealand benchmark 10-year government bonds rose 3.5 basis points and 4 basis points respectively. The AUD, CAD and NZD commodity currencies went lower, particularly against the safe-haven CHF and JPY.

Iron ore marched lower again today with headwinds continuing to batter Australia’s largest export. Further Chinese crackdowns on the property sector, inventory build-up and more blast furnaces closing for maintenance were cited as the catalyst for the move.

Looking ahead there is the ECB rate decision and US jobless claims data. The ECB is expected to leaves rates unchanged but attention will be focused on the highly elevated level of asset purchases and if they are to continue at the same pace or not.

AUD/USD, S&P ASX 200 AND IRON ORE

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Daniel McCarthy

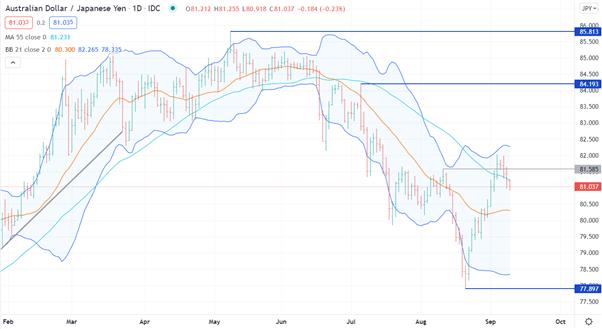

AUD/JPY Technical Analysis

AUD/JPY moved lower today after failing to hit the upper band of the 21-day simple moving average (SMA), 2 standard deviation Bolling Band this week. A move up last week through the resistance level at 81.58 has since reversed back through this boundary and continued lower to break below the 55-day moving average at 81.23.

The fast-moving rally from the recent low of 77.89 to the high of 82.02 means that in the event of a reversal, there may not be many technical support levels. The next level that may support AUD/JPY is at the 21-day SMA, currently at 80.30.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter