Euro, EUR/USD, Fiscal Stimulus, Coronavirus Vaccinations, Inflation Expectations – Talking Points:

- Equity markets traded mixed during APAC trade as investors weighed the impact of rising inflation expectations.

- The Euro-area’s cumbersome vaccine rollout may limit the Euro’s upside against the US Dollar.

- EUR/USD is challenging a key inflection point. Is a continued push lower on the cards or is the exchange rate poised to move higher?

Asia-Pacific Recap

Equity markets traded broadly mixed during Asia-Pacific trade, as investors weighed US stimulus prospects and the fallout of rising inflation expectations on stock prices. Australia’s ASX 200 slid 0.86% while Japan’s Nikkei 225 rose 0.34%. China’s CSI 300 soared 1.7% as the nation recorded a second day of no locally transmitted coronavirus infections.

In FX markets, the cyclically-sensitive AUD, NZD and NOK largely outperformed, while the haven-associated USD lost ground. Gold and silver pushed higher, buoyed by a weaker Greenback and yields on US 10-year Treasuries dipping back below 1.16%.

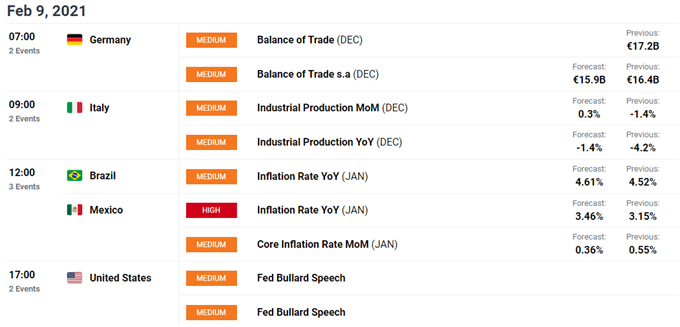

Looking ahead, inflation figures out of Mexico and Brazil headline the economic docket alongside a speech from Federal Reserve Governor Lael Brainard.

DailyFX Economic Calendar

Stimulus Hopes Underpinning EUR/USD Despite Poor Vaccination Rate

The Euro has rebounded strongly against the US Dollar in recent days, on the back of growing hopes that a substantial fiscal support package will be delivered by US lawmakers in the coming weeks. Democrats in both the House and Senate filed joint budget resolutions that will allow President Biden to pass the majority of his proposed $1.9 trillion package with a simple majority.

Indeed, with recent data showing that the recovery in the US is slowing, it appears likely that more support is needed to support the local economy. Friday’s non-farm payrolls report showed that the local economy added a paltry 49,000 jobs last month while the unemployment rate fell from 6.7% to 6.3%, driven in part by fewer people actively searching for employment.

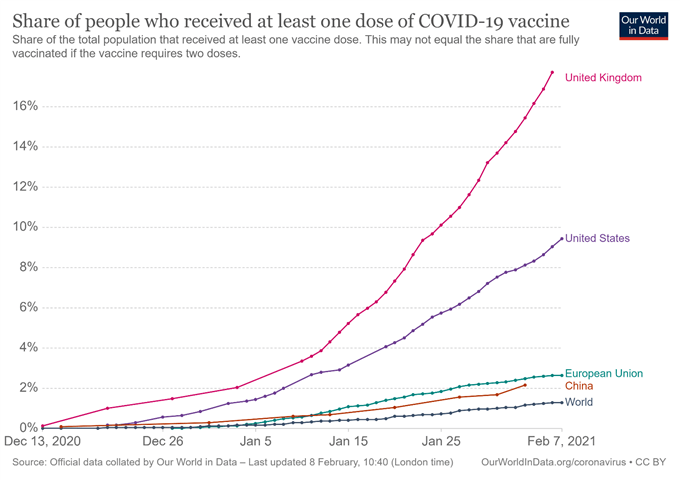

However, the European Union’s cumbersome vaccine rollout could limit the EUR/USD exchange rate’s upside, considering a meagre 2.65% of the population has received at least one dose of a coronavirus vaccine. To contrast, 17.7% of the UK population and 9.44% of Americans have been inoculated with at least one dose.

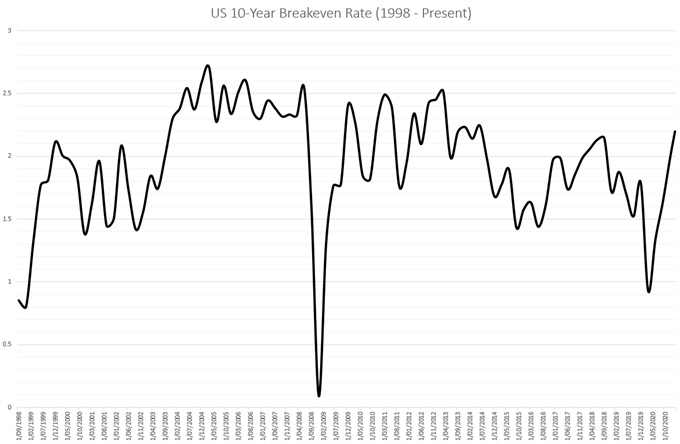

Moreover, the notable pickup in inflation could continue to fuel bets that the Federal Reserve may tighten its monetary policy levers sooner than expected. The 10-year Breakeven Rate has surged past 2% to climb to its highest levels since 2014.

Therefore, investors should intently watch upcoming data releases to determine the trajectory of EUR/USD rates. A larger-than-expected rise in US consumer price growth, in tandem with disappointing industrial production figures out of several Euro-area nations, would probably trigger further downside for the exchange rate.

Data Source – Bloomberg

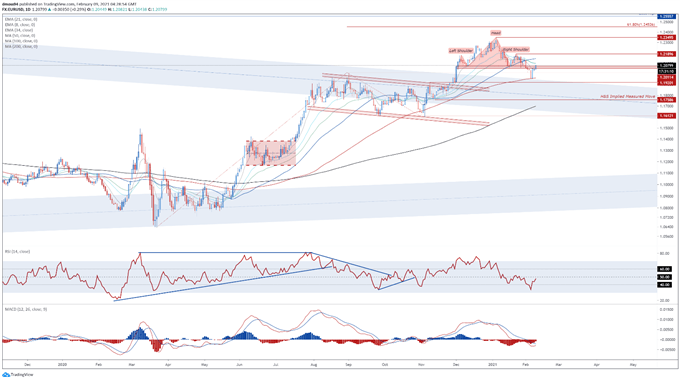

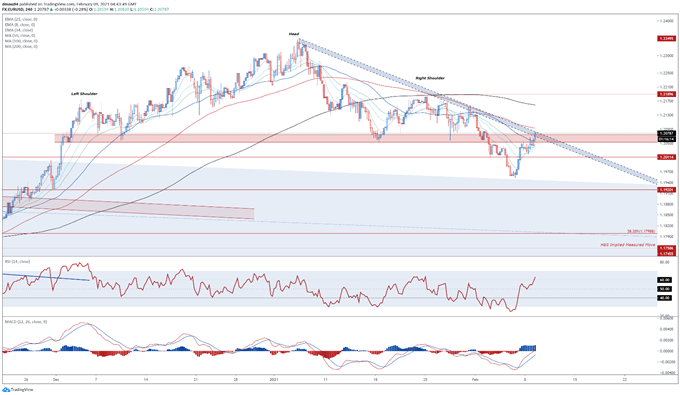

EUR/USD Daily Chart – Testing Neckline Support-Turned-Resistance

EUR/USD is challenging former resistance-turned-support at the Head and Shoulders neckline, after bursting away from the 100-day moving average (1.1963).

With the MACD gearing up to cross above its ‘slower’ signal line counterpart, and the RSI climbing back towards its neutral midpoint, a more extended recovery could be on the cards.

However, failing to gain a firm foothold above resistance at 1.2075 on a daily close basis would probably open the door for sellers to drive the exchange rate back towards the monthly low (1.1952). Clearing that likely paves the way for price to fulfil the Head and Shoulders pattern’s implied measured move (1.1759).

Conversely, a daily close above the 34-EMA (1.2102) could intensify buying pressure and bring the January 22 high (1.2190) into the crosshairs.

EUR/USD daily chart created using Tradingview

EUR/USD 4-Hour Chart – Challenging Monthly Downtrend

Zooming into the 4-hour chart shows price challenging key confluent resistance at the downtrend extending from the January high and range resistance at 1.2055 – 1.2075.

The development of the RSI and MACD indicator hint at swelling bullish momentum, as both oscillators climb to their highest intraday levels since January 25.

However, failing to convincingly push above the 100-MA (1.2093) could generate an impulsive downside push back towards psychological support at 1.2000. Hurdling that likely carves a path for sellers to retest the monthly low (1.1952).

Alternatively, slicing through the 100-MA would probably neutralize near-term selling pressure and bring the sentiment-defining 200-MA (1.2159) into play.

EUR/USD 4-hour chart created using Tradingview

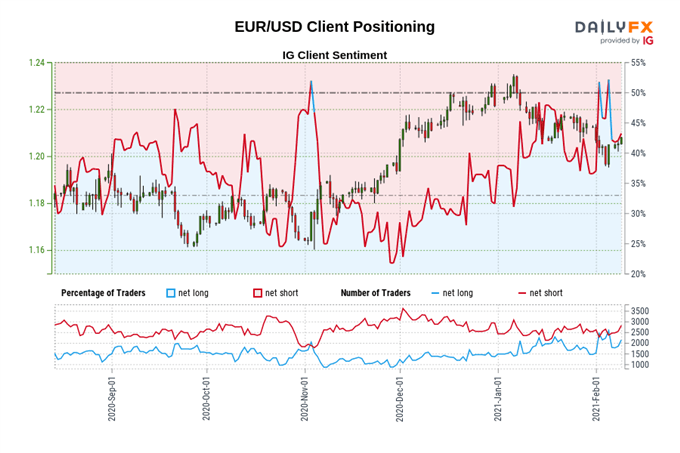

IG Client Sentiment Report

The IG Client Sentiment Report shows 44.16% of traders are net-long with the ratio of traders short to long at 1.26 to 1. The number of traders net-long is 11.49% higher than yesterday and 12.31% lower from last week, while the number of traders net-short is 1.64% lower than yesterday and 11.82% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss