DAX 30 Index, Coronavirus Vaccine, Lockdown Restrictions, Brexit, IGCS – Talking Points:

- Equity markets gained ground during APAC trade as investors cheered the US House of Representatives push for increased stimulus checks.

- The distribution of Pfizer’s Covid-19 vaccine, in tandem with a resolution in Brexit talks, sent the German DAX 30 index soaring to fresh record highs.

- However, bearish RSI divergence suggests a short-term pullback could be in the offing.

Asia-Pacific Recap

Equity markets broadly gained during Asia-Pacific trade, buoyed by news that the US House of Representatives had backed President Donald Trump’s calls for an increase in stimulus payments from $600 to $2,000.

Australia’s ASX 200 index rose 0.53% while Japan’s Nikkei 225 soared to its highest levels in 30 years, climbing 2.66%. China’s CSI 300 index fell 0.32% as investors mulled the possibility of an anti-trust investigation into Alibaba by Chinese authorities.

In FX markets, the cyclically-sensitive NOK and NZD largely outperformed, while the haven-associated USD and JPY dipped lower against their major counterparts.

Gold recovered lost ground while silver prices slipped lower as yields on US 10-year Treasuries crept 1 basis point higher.

Looking ahead, unemployment data out of Brazil headlines a rather light economic docket as market participants remain intently focused on how the Senate will vote on the House’s bill.

Vaccine Rollout, Brexit Relief Buoying EU Stocks

The approval of Pfizer and BioNTech’s coronavirus vaccine by European regulators, in tandem with the UK and EU finally agreeing on a Brexit trade deal, has sent the German benchmark DAX 30 index storming higher in recent days. The index has climbed over 4% this month to exceed the previous record high set in February.

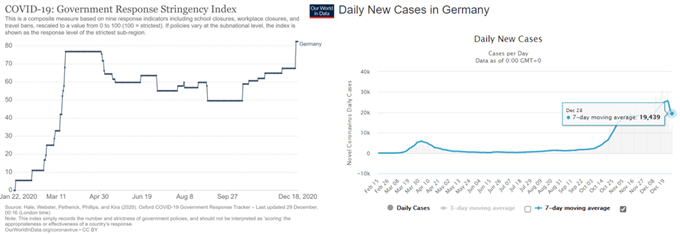

However, investors may be getting a bit of themselves given the nation is currently under strict lockdown measures and is averaging over 19,000 new daily coronavirus infections.

Sources – Worldometer, University of Oxford

Indeed, Interior Minister Horst Seehofer has warned that “if the lockdown does not have a sufficient effect, the measures must be tightened” in order to avoid a potential third wave of the virus. Therefore, it appears market participants may be banking on a swift return to normalcy in light of the recent vaccine approval.

That being said, several health officials have warned that it will take several months for the vaccine rollout to have a measurable impact on the virus. Nevertheless, investors may dismiss these concerns in the short-term and continue to put a premium on European equity indices despite the notable deterioration in local health outcomes.

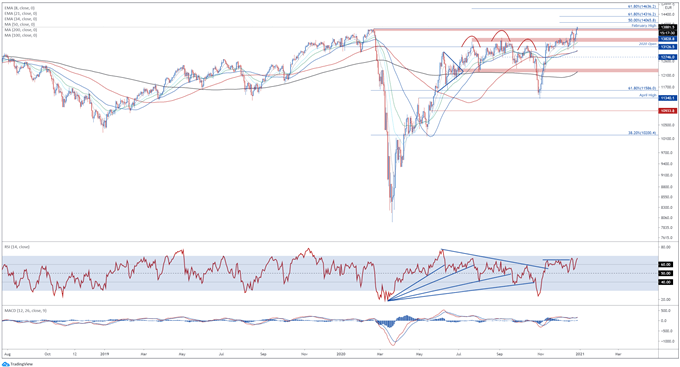

DAX 30 Index Futures Daily Chart – Eyeing Psychological Resistance

DAX 30 index futures daily chart created using Tradingview

From a technical perspective, the DAX 30 index looks set to extend its push to fresh record highs, after bursting through key range resistance at 13780 – 18820.

With the RSI eyeing a push into overbought territory, and the slopes of all six moving averages notably steepening, the path of least resistance seems to favour the upside.

A daily close above the February high (13829) would probably carve a path for prices to probe psychological resistance at 14000 and the 50% Fibonacci (14067), with a break above bringing the 61.8% Fibonacci into focus (14316).

Conversely, slipping back below the February high could trigger a short-term pullback towards support at the November high (13447).

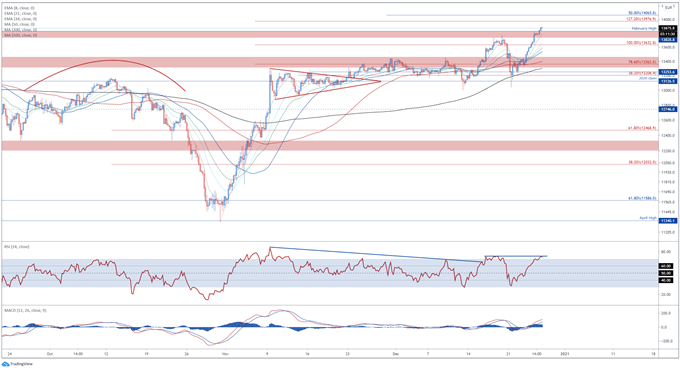

DAX 30 Index Futures 4-Hour Chart – RSI Divergence Hints at Pullback

DAX 30 index futures 4-hour chart created using Tradingview

However, bearish RSI divergence on the four-hour chart suggests that a near-term pullback towards former resistance-turned-support at 13800 is on the cards.

This level may provide the perfect springboard for buyers to continue driving the index higher, with a convincing push above 13900 opening the door for prices to probe the 127.2% Fibonacci expansion (13978).

Alternatively, failure to remain constructively perched above 13800 could allow sellers to regain control and generate a downside push back towards the December 18 high (13773).

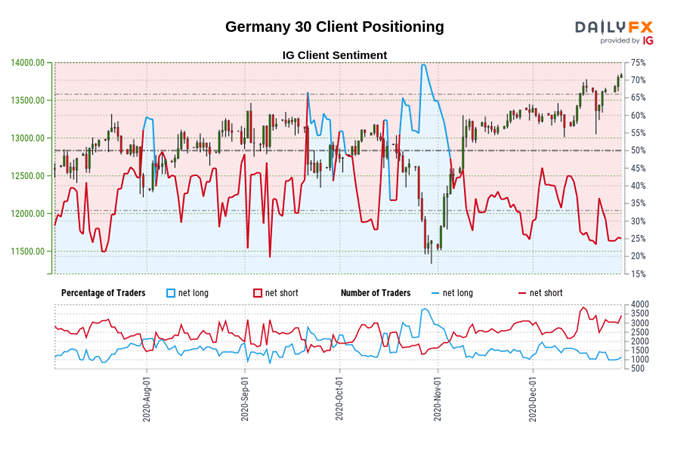

The IG Client Sentiment Report shows 24.47% of traders are net-long with the ratio of traders short to long at 3.09 to 1. The number of traders net-long is 0.48% higher than yesterday and 20.46% lower from last week, while the number of traders net-short is 9.76% higher than yesterday and 34.60% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests DAX 30 prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger DAX 30-bullish contrarian trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss

https://www.dailyfx.com/sentiment-report?ref-author=Moss