Gold Prices, Federal Reserve, Congress, Coronavirus Vaccine, Monetary Policy – Talking Points:

- The historic signing of the world’s largest free-trade agreement notably buoyed Asian equity markets.

- Potential adjustment of the Federal Reserve’s asset purchasing program may underpin gold prices.

- Fading vaccine optimism may also direct capital back into bullion.

Asia-Pacific Recap

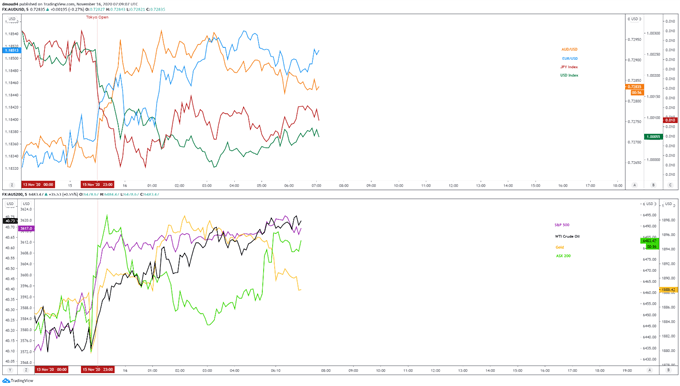

Asian equity markets continued to push higher during Asia-Pacific trade, as regional investors cheered regional trade progress and resistance to enforcing a national lockdown in the United States.

Japan’s Nikkei 225 soared over 2% on the back of better-than-expected GDP results and the signing of the world’s largest free trade agreement, known as the Regional Comprehensive Economic Partnership (RCEP).

Australia’s ASX 200 climbed 1.2% before market data issues resulted in the suspension of share trading.

The haven-associated US Dollar and Japanese Yen continued to lose ground against their major counterparts, while the cyclically-sensitive AUD, NZD, CAD and NOK all largely outperformed.

Copper surged over 2.5% after Chinese industrial production figures for October exceeded market expectations.

Looking ahead, a slew of speeches from several members of the European Central Bank and Federal Reserve headline the economic docket.

Market reaction chart created using TradingView

Dovish FOMC Underpinning Gold Prices

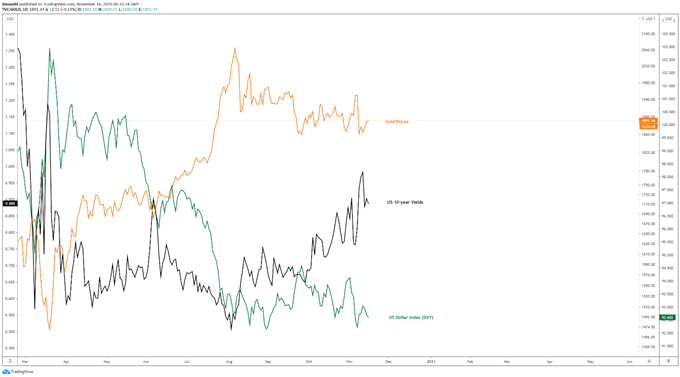

Gold prices have notably consolidated since surging to a record high on the 7th of August, due in part to the absence of additional fiscal aid and the Federal Reserve’s wait-and-see approach to monetary policy.

The marked sell-off in US Treasuries has also hampered the performance of the anti-fiat asset, with 10-year yields climbing over 47 basis points since bottoming at 0.504% on August 6th.

However, the longer-term outlook for bullion remains constructive given recent suggestions from members of the Federal Reserve that a shift in the central bank’s bond purchasing program could be on the table.

Gold, US10Y, DXY chart created using TradingView

Chairman Jerome Powell and his colleagues discussed the central bank’s asset purchases and “the ways in which we can adjust the parameters of it to deliver more accommodation if it turns out to be appropriate” at the FOMC monetary policy meeting on November 6.

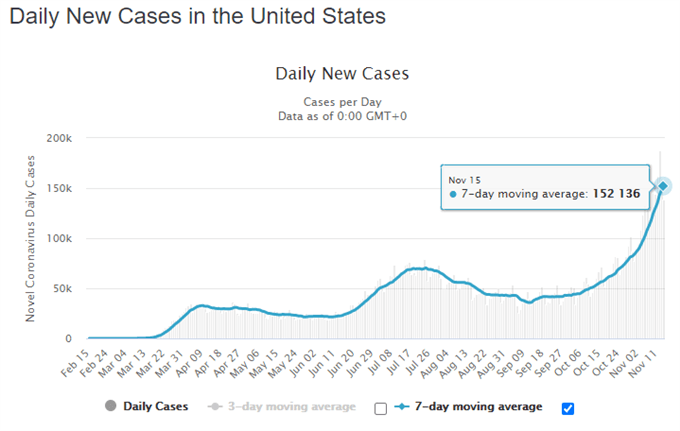

Given daily coronavirus cases continue to surge nationally and the Fed’s belief that “the ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term”, additional monetary support looks more than likely.

Moreover, with Senate Majority Leader Mitch McConnell taking over from Treasury Secretary Steven Mnuchin in fiscal support negotiations, it seems relatively unlikely that Congress will pass a stimulus package before President-elect Biden’s inauguration on January 20. This could pressure the Federal Reserve to pick up the slack in the interim.

Source – Worldometer

Ebbing Vaccine Optimism to Compress Yields

Ebbing vaccine optimism may also buoy precious metals in the coming days, as the sectoral rotation into value-related stocks – which have struggled in the wake of the Covid-19 pandemic – begins to subside.

Investors dumped bonds and piled into equity markets after Pfizer reported that its coronavirus vaccine was more that 90% effective in clinical trials. This may prove short-lived however, given the notable concerns surrounding transport, storage and distribution of the vaccine.

After all, the shots require a storage temperature of -70 degrees Celsius and two doses are needed to successfully inoculate a subject. This reality may temper the current sectoral rotation and direct capital back into bond markets, compressing bond yields and in turn supporting gold prices.

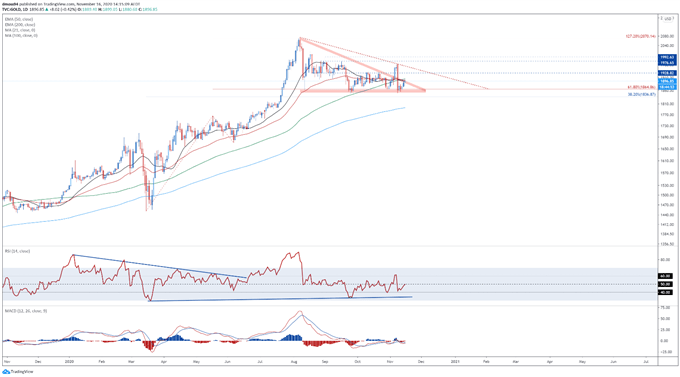

Gold Daily Chart – 50-DMA Capping Topside Potential

Gold prices daily chart created using TradingView

The technical outlook for gold prices remains skewed to the topside, as price holds firmly above key support at the 61.8% Fibonacci (1864.86).

However, a near-term pullback could be in the offing if resistance at the trend-defining 50-day moving average (1899.89) holds firm.

Inability to clear the 1900 mark may open the door to a pullback to the support range at 1850 – 1860, with a push below bringing the sentiment-defining 200-DMA (1795.8) into play.

That being said, an extended turn lower seems relatively unlikely, as the RSI bounces back towards its neutral midpoint and the MACD eyes a bullish cross above its ‘slower’ signal line.

Ultimately, a daily close above the 100-DMA (1905.5) is needed to ignite a push towards the August 19 close (1928.82). Breaking through that may signal the resumption of the primary uptrend and expose the yearly high set on August 6 (2075.14).

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss