EUR/CHF, DAX 30 Index, Angela Merkel, Vaccine, Coronavirus Restrictions – Talking Points:

- Asian equity markets followed their US counterparts lower during APAC trade.

- Germany’s flattening infection curve may underpin regional asset prices.

- EUR/CHF may push higher after breaching long-term resistance.

- DAX 30 index approaching key inflection point after surging over 15% from the monthly low.

Asia-Pacific Recap

Asia-Pacific equity markets followed their US counterparts lower as vaccine optimism abated amid a record surge of Covid-19 cases in the United States.

Australia’s ASX 200 index slipped 0.2% while Japan’s Nikkei 225 dropped 0.74%. China’s CSI 300 index plunged over 1.4% after President Donald Trump signed an executive order banning US investments in Chinese companies linked to the nation’s military.

The haven-associated US Dollar and Japanese Yen broadly gained ground while the cyclically-sensitive CAD, NZD and NOK largely underperformed. Gold prices moved marginally higher as yields on US 10-year Treasuries dipped lower.

Looking ahead, Euro-area second-quarter GDP could prove market moving alongside US PPI data for the month of October.

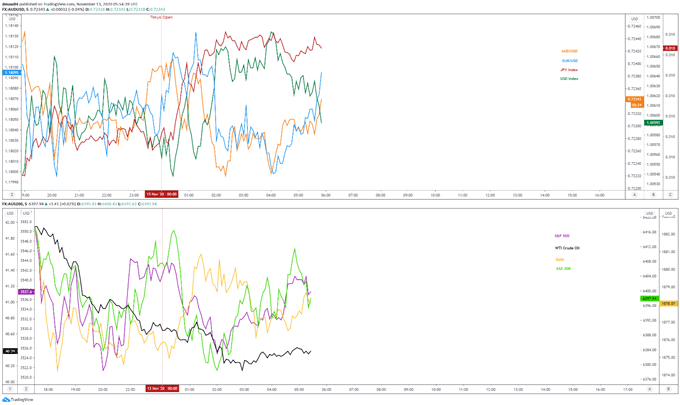

Market reaction chart created using TradingView

EUR/CHF Rise Hints at Further Gains for DAX 30

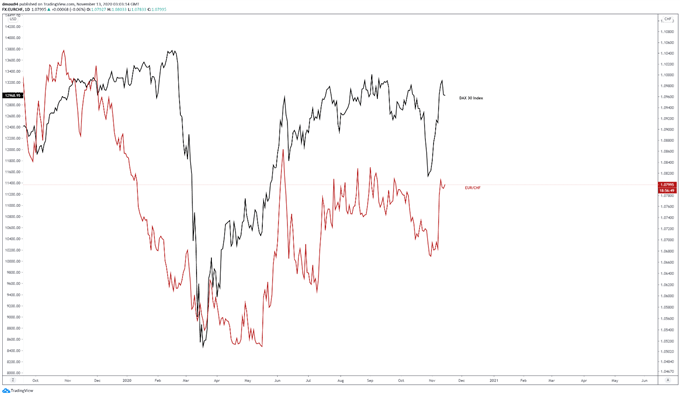

The EUR/CHF exchange rate has often been used as a proxy for risk appetite and may be hinting at further gains for European equity markets, after breaking above long-term trend resistance.

Benchmark equity indices have soared higher in recent days, on the back of positive coronavirus vaccine progress and the expectation of a more diplomatic approach to foreign policy under President-elect Joe Biden.

It was noted in previous reports however, that investors may be getting ahead of themselves given the deteriorating health and economic conditions in several European nations.

Indeed, the reality of rising Covid-19 cases and tightening restrictions seemed to douse vaccine optimism, with the DAX 30 slipping over 1.2% lower overnight.

DAX 30, EUR/CHF chart created using TradingView

That being said, an extended reversal lower appears relatively unlikely. After all, the vaccine – developed by Pfizer and BioNTech – proved to be 90% effective in clinical trials, much higher than even the most optimistic expectations for a first-generation vaccine.

It is also the first to utilize messenger-RNA technology, which enables the vaccine to be tweaked to target different mutations of the novel coronavirus.

These promising results bode well for the much-anticipated release of Moderna’s vaccine results later this month, which utilizes the same mRNA technology.

Of course, the timeline for mass distribution and the concerns around storage remain. However, the potential delivery of a more effective vaccine than originally expected may soothe investors’ concerns and direct capital back into risk-associated assets.

Risk of Extended Restrictions May Stoke Risk Aversion

That being said, the threat of extended restrictions in Germany may inspire liquidation of risk-sensitive positions, as Chancellor Angela Merkel stresses that “we’re doing everything in order to make progress in December, but we need to get through the tough winter months”.

Lothat Wieler, head of the Robert Koch Institute, also warned residents to “be prepared for the situation to get worse in coming weeks”.

This suggests that local health authorities have yet to rule out extending the month-long national lockdown imposed on November 2.

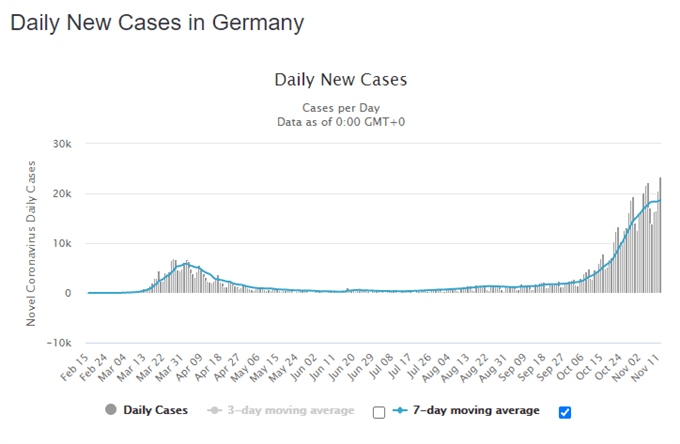

Source – Worldometer

Nevertheless, the 7-day moving average tracking Covid-19 infections has notably flattened in recent days, suggesting restrictions are starting to have an impact.

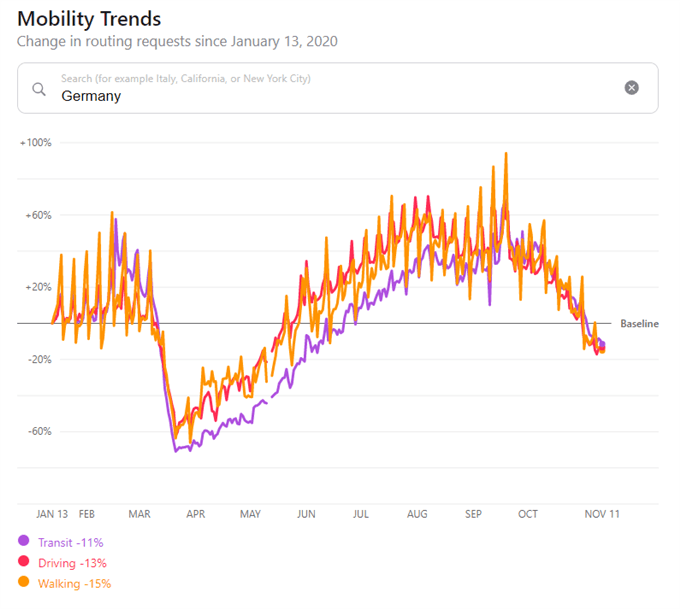

High-frequency data has also stabilized just below the pre-coronavirus baseline, reflecting the more targeted nature of current measures which allows most of the economy – outside of the services industry – to continue operating.

Therefore, investors should continue to monitor ongoing health developments, with a marked decline in infections probably persuading Merkel to stick to her proposed timeline and in turn buoying regional asset prices.

Source – Apple Mobility Data

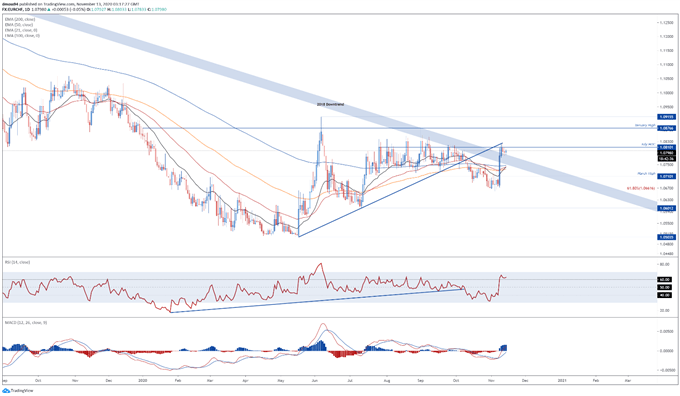

EUR/CHF Daily Chart – Break Above Long-Term Resistance Hints at Gains

The technical outlook for EUR/CHF rates seems skewed to the topside after breaching long-term trend resistance extending from the 2018 high (1.2005).

With price perched constructively above former resistance-turned-support and the RSI eyeing a push into overbought territory, the path of least resistance appears to favour the upside.

A daily close above the July 27 close (1.0810) may neutralize selling pressure and carve a path to challenge the January high (1.0876). Pushing through that would probably bring the yearly high (1.0915) into focus.

Conversely, breaking through support at the November 10 low (1.0773) could ignite a pullback to the sentiment-defining 200-day moving average (1.0747).

EUR/CHF daily chart created using TradingView

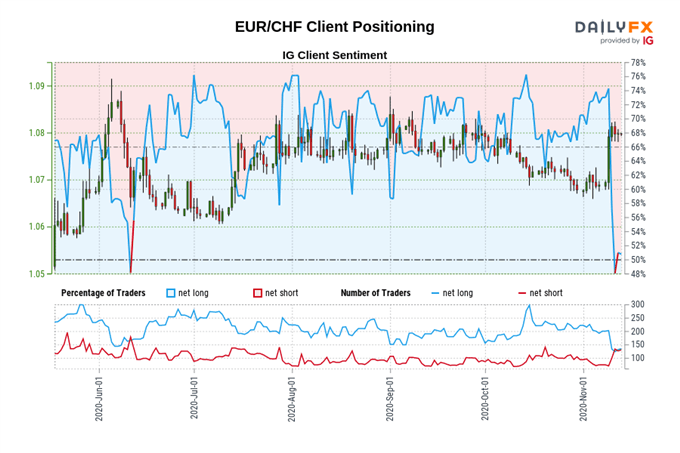

EUR/CHF Trader Sentiment

Retail trader data shows 48.16% of traders are net-long with the ratio of traders short to long at 1.08 to 1. The number of traders net-long is unchanged than yesterday and 31.77% lower from last week, while the number of traders net-short is 11.90% higher than yesterday and 95.83% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/CHF prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/CHF-bullish contrarian trading bias.

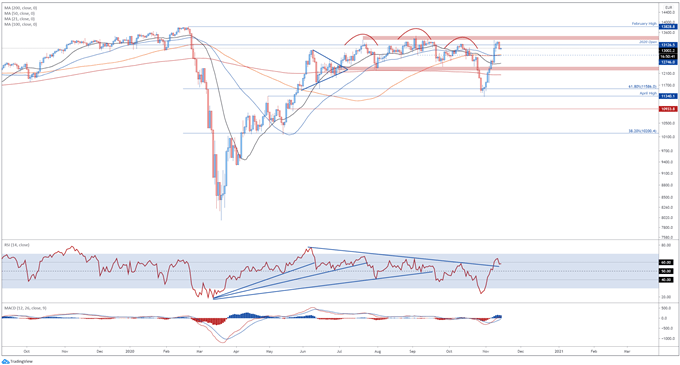

DAX 30 Index Futures Daily Chart – Eyeing February High

Germany’s benchmark DAX 30 index is approaching a key inflection point after surging over 17% from key support at the April high (11340).

The development of the RSI and MACD indicator hint at swelling bullish momentum, as both oscillators climb to their highest levels since early September.

A challenge of the resistance range at 13350 – 13450 looks likely in the coming days if price can hold a firm foothold above the psychologically imposing 13000 mark.

Breaching resistance would probably bring the February high (13829) into play, with a daily close above exposing the 61.8% Fibonacci expansion level (14636).

Alternatively, failure to hold above psychological support could open the door for a pullback towards the 50-DMA (12732). A break below portending deeper losses and bringing the support range at 12200 – 12300 into the crosshairs.

DAX 30 index futures daily chart created using TradingView

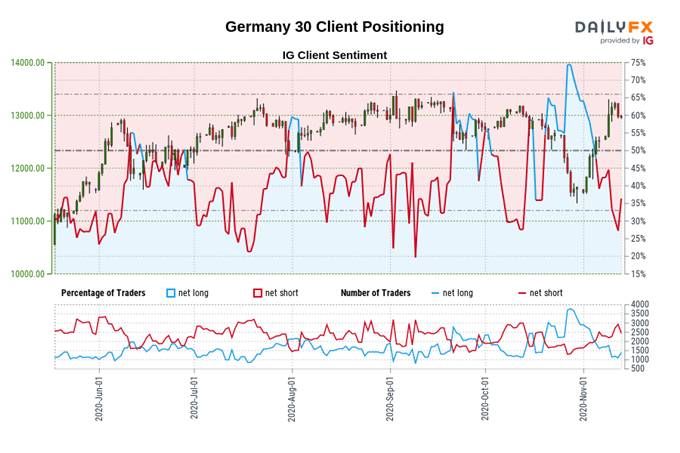

DAX 30 Index Trader Sentiment

Retail trader data shows 36.01% of traders are net-long with the ratio of traders short to long at 1.78 to 1. The number of traders net-long is 23.57% higher than yesterday and 16.85% lower from last week, while the number of traders net-short is 15.18% lower than yesterday and 3.60% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests DAX 30 prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed DAX 30 trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss