DAX 30, COVID-19, Europe Open, Beijing Talking Points:

- Strong risk-averse reaction to start of the new trading week as COVID-19 concerns resurfaced

- New cases in Beijing approaching 100 after outbreak at market

- DAX 30 slices 12-week uptrend and 200-MA. Is this the resumption of the primary downtrend?

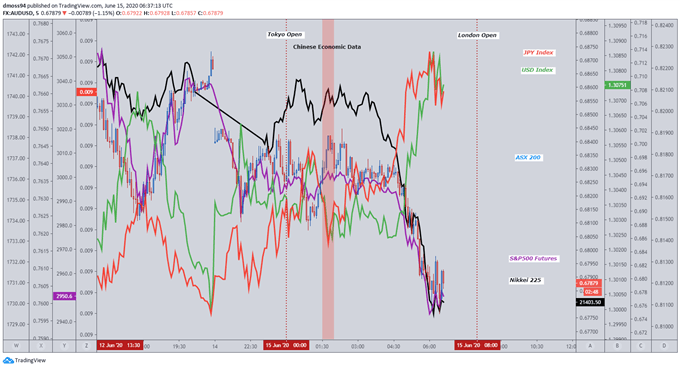

Asia-Pacific Recap

Risk aversion was the motto of the day in Asia-Pacific trade as a surge of new cases in the US, Tokyo and China spooked market participants.

The ASX 200 fell over 2% as the Nikkei 225 collapsed as much as 3.5%, with investors fleeing into the haven associated US Dollar and Japanese Yen.

S&P 500 futures followed APAC equities lower, as did the risk-associated New Zealand and Australian Dollars.

Looking forward, investor focus will turn to the Bank of Japan’s interest rate decision tomorrow, with the central bank expected to keep its policy measures on hold.

Source – Trading View

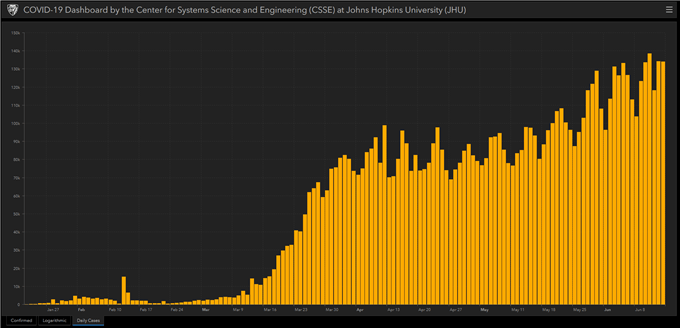

Beijing Outbreak Fuels Risk Aversion

As the number of new COVID-19 cases in Beijing approaches 100 market participants fled to haven-associated assets, as the country leading the way in terms of an economic recovery faces the reality of imposing draconian lockdown measures in its capital.

China has had a great degree of success controlling outbreaks in regional areas but has yet to see a significant surge in cases in a major city.

However, with 10,000 people possibly exposed to the pathogen an outbreak in China’s largest city could turn into a reality.

The imposition of the aggressive lockdown measures used to tame the outbreak in Wuhan may not be deemed as appropriate in the cultural and political hub of the world’s second largest economy and could lead to a further outbreak of cases.

With the “risk of virus spread” remaining very high Vice Premier Sun Chunlan called for “resolute and decisive measures to prevent further spread” as the head of China’s CDC advised residents not to purchase imported food or agricultural products.

Source – John Hopkins University

This recent outbreak has fuelled the fears of a secondary outbreak of the novel coronavirus as economies begin to ease the lockdown measures and social distancing restrictions that have been pivotal in ‘flattening the curve’ of infections.

With several states in the US seeing a surge in new cases, and Tokyo recording its highest number of cases since May 5, investors are beginning to ponder the reality of continued disruptions to supply and demand chains in the absence of an effective vaccine.

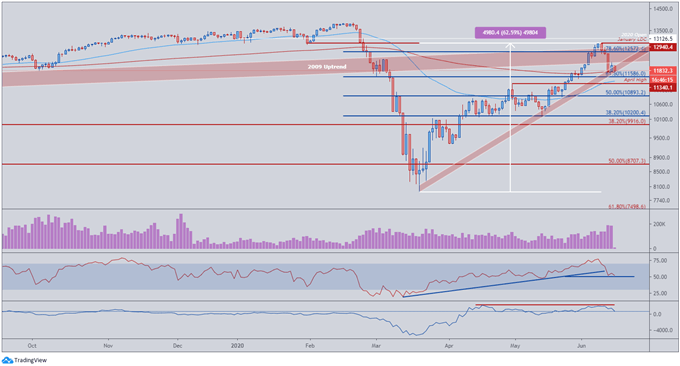

DAX 30 Price Daily Chart

Source – Trading View

The DAX closed just points away from the yearly open (13,126) as the RSI surged into overbought territory for the first time since November 2019 pushing priceback above the 2009 uptrend to test the January low daily close (12,940).

The psychological imposing 13,000-handle may continue to cap the 3-month rally as three consecutive days of selling pushed the German benchmark back to the 200-day moving average (11,782) with the noticeable increase in volume confirming the bearish price action.

Bearish divergence, as the momentum indicator fails to follow price to new highs, may reinforce downside bias as the RSI snaps its 12-week uptrend and dives below the bullish region of 60.

A break of the March uptrend, confirmed by a daily close below the 61.8% Fibonacci (11,586), may re-ignite downside enthusiasm with a break of the April high (11,586) possibly carving a path back to the psychologically imposing 10,000-handle.

However, should support at the 200-MA (11,782) hold and RSI remain constructive above the neutral reading of 50, price may push to re-test the 78.6% Fibonacci (12,572) with the monthly high (12,940) possibly continuing to cap topside potential.

-- Written by Daniel Moss

Follow me on Twitter @DanielGMoss