EU COMMISSION, RECOVERY FUND, CHF, FRANC, SIKA – TALKING POINTS:

- EU Commission to unveil proposed plan for regional recovery fund

- Swiss Franc lower vs FX majors asSaint-Gobain divests from Sika

- S&P 500 index futures point to a risk-on tilt in underlying sentiment

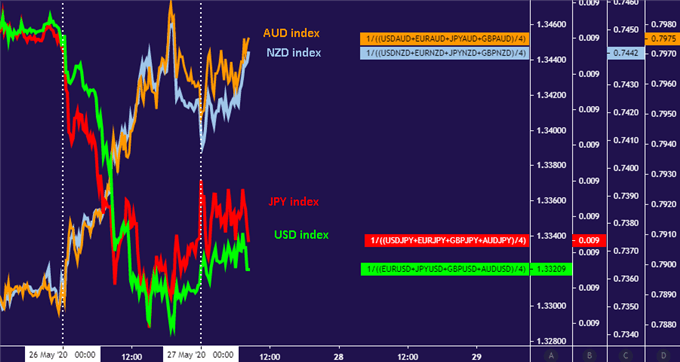

Consolidative drift marked much of the G10 FX space in Asia-Pacific trading hours. The cyclically-inclined Australian and New Zealand Dollars digested the prior day’s advance. At the opposite end of the spectrum, the anti-risk US Dollar and Japanese Yen licked their wounds.

Sluggish price action echoed a similarly indecisive tone on APAC exchanges. A regional average narrowly pulled back having jumped 1.84 percent yesterday, marking the largest daily rise in over a month. Hopes for a pickup in economic activity as lockdowns ease are perhaps tempered by renewed US-China tensions.

Chart created with TradingView

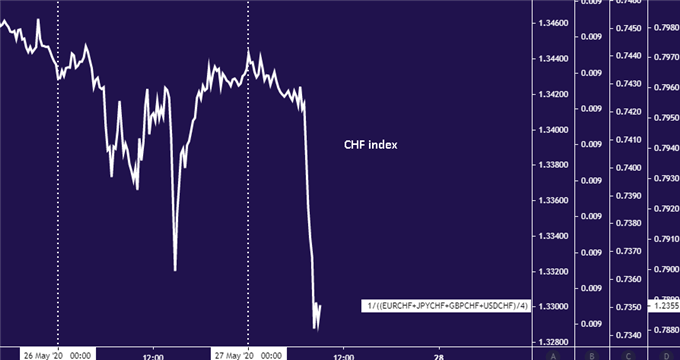

The Swiss Franc was a notable standout. It sank alongside Switzerland’s benchmark SMI stock index at Wednesday’s trading open as French materials maker Saint-Gobain divested of its share in Swiss adhesives maker Sika. A weaker CHF seemed to reflect the exit’s underlying capital flow implications.

Chart created with TradingView

Looking ahead, the spotlight turns to the EU Commission, which is due to deliver a revamped long-term budget in the wake of the Covid-19 outbreak. It is to unveil a recovery fund seeded by the member states to finance region-wide fiscal stimulus to countering the growth slump brought on by the pandemic.

So far, Germany and France have voiced support for €500 billion in grants. A more austere block including Austria, Denmark, Sweden and the Netherlands prefer to limit the effort to loans. Where the Commission lands on the issue may set the stage for upcoming debate until national governments reach consensus.

As it stands, rising S&P 500 stock index futures point to a risk-on tilt in the hours ahead. If the EU underwhelms – either by offering something too modest to have a big-splash impact or so ambitious that it might only inflame divisions further – the markets’ mood may sour.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

.jpg)