US Dollar, FOMC Minutes, German PMI Data, Euro, EUR/USD Analysis – Talking Points

- USD may rise after FOMC minutes released – what did Powell say about key metrics to watch?

- Euro may suffer ahead of the publication of consumer confidence and German PMI statistics

- EUR/USD sideways price action may soon be coming to an end – what’s the directional bias?

Asia-Pacific Recap

The growth-oriented New Zealand Dollar versus its G10 counterparts while the anti-risk Japanese Yen fell. US equity futures popped higher with Asia-Pacific stocks, indicating investors were feeling jubilant early into the session. The People’s Bank of China (PBoC) announced it was holding its 5-year and 1-year Loan Prime Rate unchanged at 4.65 and 3.85 percent, respectively.

US Dollar May Rise on FOMC Minutes

The US Dollar may rise after the minutes from the April 28-29 FOMC meeting are released. The text itself is likely to carry a gloomy undertone as the global economy wrestles with the biggest economic shock in living memory to quote Fed Chairman Jerome Powell. It is unclear how relevant the content may be given that the incredibly volatile situation around the coronavirus pandemic continues to shift the global policy landscape.

Having said that, one of the gold nuggets analysts and policymakers alike will be eagerly scanning for will be mentions on the use of negative interest rates. Recently, there had been widespread speculation that monetary authorities would consider experimenting with sub-zero policies. When these rumors became reflected in overnight index swaps, the Greenback fell.

However, Mr. Powell has made it clear that monetary authorities are not looking to use negative interest rates as a policy measure considering its “unclear benefits and clear costs”. Following his commentary on the matter, the US Dollar jumped. He also made it clear that virus-related medical metrics are the most important data for the US economy and the most crucial to monitor because of how policy will be crafted around them.

Powell, Mnuchin Testimony Highlights

Yesterday, Fed Chairman Jerome Powell and Treasury Secretary Steven Mnuchin both testified in front of the Senate Banking Committee on the policies aimed at mitigating the impact of the coronavirus pandemic. The Chairman said that the scope and speed of the current downturn is without modern precedent and warned that lasting unemployment from the crisis could weigh on the economy for years.

He added that the Fed will use the full range of tools at its disposal to support the economy, but added that monetary authorities and the government will have to jointly inject stimulatory measures. Having said that, Mr. Powell also said it was not the Fed’s role to discuss the timing or design of fiscal policy. He has made it clear that the central bank will not weigh in on matters outside the scope of its mandate i.e. political.

Having said that, the Chairman did point out to policymakers that the question about whether the fiscal response being enough thus far is “looming” in the air. The day before the testimony, he said he agreed with the unemployment projections peaking at around 20-25 percent, and added that the Fed has not run out of ammunition and will do more if necessary.

Mr. Mnuchin added onto this at the testimony, warning that the jobs numbers will likely get worse before they better. He made it clear that in an effort to combat the economic impact, the Treasury was prepared to provide additional capital and expedite lending programs being created by the Fed. Another key takeaway was his announcement of two of the remaining aid programs will be ready for implementation by the end of May.

Euro Braces for German PMI Data, Eurozone Consumer Confidence

The Euro may face heightened liquidation pressure ahead of the release of preliminary German manufacturing, services and composite PMI and Eurozone consumer confidence data. This follows published highly-watched German ZEW statistics that showed the Current Situation component registering a dismal -93.5 reading, far below the -86.6 estimate. It was the weakest outcome in 17 years.

As the largest economy in the region, data out of Germany typically carries a higher premium relative to other member states and is frequently reflected in greater Euro volatility. Up next, preliminary Eurozone consumer confidence data for May is anticipates to show a -23.8 print, slightly worse than the previous -22.7 reading. A worse-than-expected figure could amplify selling pressure in the Euro.

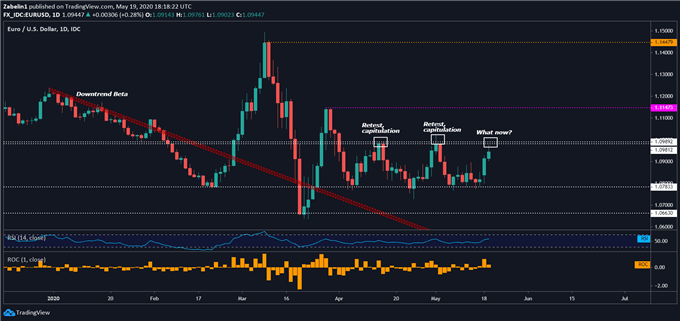

EUR/USD Technical Outlook

EUR/USD may aim to challenge a formidable inflection zone between 1.0981 and 1.0989 after failure to break above it in mid-April and early May. Capitulation could catalyze a selloff and send the pair crashing through the floor at 1.0783. For over a month, EUR/USD has traded within these price parameters. A break above or below those bands with follow-through could precede a short-term bullish or bearish streak.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter