US Dollar, US Retail Sales Data, IMF Global Economy Outlook, Coronavirus – Talking Points

- US Dollar may rise if a first look ar March retail sales data spooks the markets

- IMF warned of slower growth, tightened credit conditions slowdown in trade

- EUR/USD broke out of a key resistance range, but how far will the pair climb?

APAC RECAP

The anti-risk Japanese Yen was up against its G10 counterparts while the growth-oriented Australian and New Zealand Dollars were both in the red, reflecting a broad risk-off tilt in FX markets. Asia-Pacific equities were mixed after a rosy session on Wall Street. US President Donald Trump held a press conference and announced a suspension of payments to the World Health Organization (WHO) but this did not appear to make a sizeable impact on markets.

US DOLLAR MAY RISE ON US ADVANCED RETAIL SALES DATA

The US Dollar may rise if preliminary, month-on-month retail sales data for March out of the largest consumer-driven economy in the world reinforces fears about a deep recession. Analysts are anticipating a -8.0 percent print, which if fulfilled would mark the softest reading on record. Industrial production for the same month is also expected to print a contractionary figure at -4.0 percent.

If the statistics spark risk aversion, a premium may then be put on haven-linked currencies like the US Dollar and a discount on growth-oriented FX like the Australian and New Zealand Dollars. Emerging market currencies in particular may suffer since their cycle-sensitive nature makes them more vulnerable to changes in global sentiment.

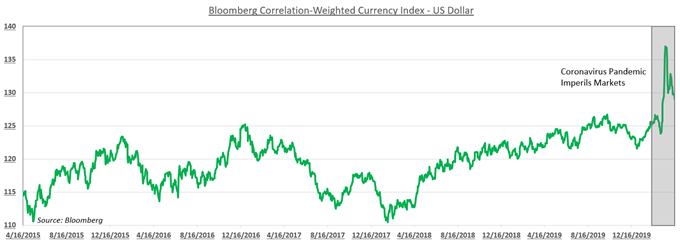

At the height of the virus-induced panic, the US Dollar surged versus its G10 counterparts as demand for liquidity rose amid fear of a deep recession. Despite the fundamentally fragile environment, sentiment appears to have shown modest signs of recovery and alleviated demand for USD. However, despite the Greenback’s recent pullback, this does not suggest that a deterioration in sentiment could not lead to another spike.

IMF OUTLOOK: KEY TAKEAWAYS FROM GFSR AND WEO

The International Monetary Fund (IMF) warned on Tuesday that due to the coronavirus, the global economy may experience the worst financial crisis this year since the Great Depression. Analysts at the Washington-based organization anticipate a 3 percent contraction in global GDP, whereas in January they had forecasted a 3.3 percent increase for 2020.

The IMF has dubbed the shelter-in-place orders as “The Great Lockdown” and anticipates unemployment to skyrocket as businesses lay off employees. Not only has this caused revenue streams to dry up, but highly-leveraged firms with an acute sensitivity to changes in the business cycle have been put under severe pressure. Consequently, tightened credit conditions from the virus have exposed “cracks” in the financial system.

Source: IMF

This is most notable in the so-called “leveraged loan” market as well as frontier economies that are having trouble getting access to credit and face downgrades of their sovereign credit ratings. In the corporate debt sector, default rates may skyrocket if the pandemic is prolonged and lockdown measures are extended. Here are links to the IMF’s World Economic Outlook and Global Financial Stability Report for additional information.

Follow me on Twitter @ZabelinDimitri for more in-depth analysis

EUR/USD TECHNICAL ANALYSIS

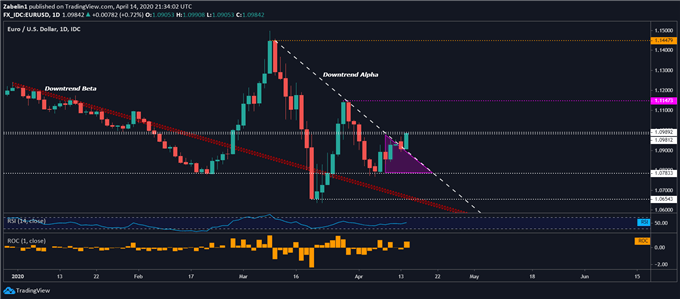

EUR/USD has broken out of the compression zone (purple-shaded area) and is now testing a key inflection range between 1.0981 and 1.0989. If it clears this zone with follow-through, the next obstacle to overcome will be resistance at 1.1147 where EUR/USD previously stalled in late March. However, if upside momentum fades, the pair may capitulate and flirt with retesting support at 1.0783.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

US DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter