Euro Analysis, EUR/USD, EU Border Shutdown – Talking Points

- Euro may face additional selling pressure as the European growth outlook darkens

- European Union leaders agreed to 30-day lockdown, banning all non-essential travel

- EUR/USD breaks below critical inflection point, opening the door to additional losses

ASIA-PACIFIC RECAP

S&P 500 futures pointed lower during Wednesday’s Asia trading session while APAC equities were broadly mixed as the British Pound gained against its G10 counterparts. A possible reason behind Sterling’s rise had to do with stimulus measure announced by Chancellor of the Exchequer Rishi Sunak who outlined government measures that will support the UK economy amid the coronavirus pandemic.

EURO OUTLOOK BEARISH AS CORONAVIRUS SPREADS

The Euro took a hit after German ZEW survey statistics fell significantly short of what were already-low estimates. The current situation report showed a -43.1 reading while the expectations component registered a dismal 49.5 print, the weakest figures since the Eurozone debt crisis. What is more worrying is the forward-looking data is considerably worse than the current assessment, suggesting those surveyed anticipate hard times ahead.

Their worries are not baseless. Eurozone growth was fragile leading up to the crisis amid a brief interim of global stabilization and reduced geopolitical tensions including Brexit and trade tensions with the US. However, the virus has now not only derailed the recovery but now policymakers including ECB President Christine Lagarde have said the region is at risk of a 2008-style crisis.

Interbank liquidity is showing signs of stress as the spread on credit default swaps (CDS) ensuring sub-investment grade corporate entities in Europe surge to their highest levels since the Eurozone debt crisis. Compounding this dilemma is the recent announcement by EU leaders who have restricted non-essential travel to the EU for citizens outside the bloc for a 30-day period.

For the tourism industry ahead of summer, this may be the nail in the coffin as potential holiday-goers reconsider their vacation plans not only to avoid contracting the coronavirus but out of fear that a downturn may be on the horizon. US President Donald Trump recently announced that the world’s largest economy – over which he presides – may enter a recession due to the virus. Consequently, consumers may be hesitant to spend on non-essential services/goods if they believe harder times lie ahead.

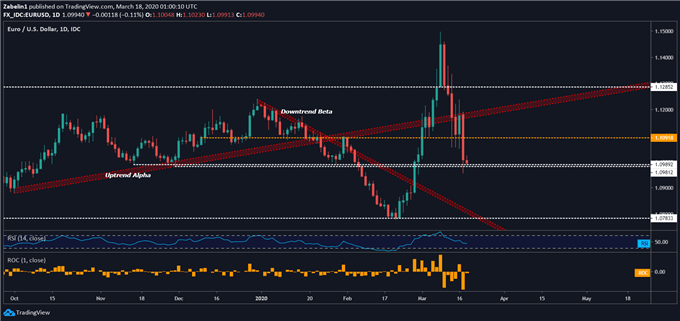

EUR/USD TECHNICAL ANALYSIS

EUR/USD experienced its biggest one-day decline June 2019 and is now trading just above a critical support range dating back to the last two months of 2019. Its break below 1.1091 – a key inflection point – may inspire further liquidation. Bearish sentiment may swell if EUR/USD breaks below the 1.0989-1.0981 range aggravates what is already-tense selling pressure.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter