US DOLLAR, FOMC, NONFARM PAYROLLS DATA, CORONAVIRUS – Talking Points

- US Dollar may fall if nonfarm payrolls data magnifies risk aversion

- Weaker growth outlook could increase urgency for more Fed easing

- EUR/USD eyeing July 2019 high as pair approaches key resistance

APAC RECAP: EQUITY SELLOFF DEEPENS

The stock market selloff during Wall Street echoed into Asia with APAC equities in the red as S&P futures dipped over one percent along with a general decline in risk appetite. The anti-risk Japanese Yen rose against its G10 counterparts but particularly those of a commodity-linked nature like the Australian and New Zealand Dollars. Fear about the coronavirus continues to spread as the number of those infected is now at 97,879.

US DOLLAR MAY SUFFER IF NFP DATA AMPLIFIES RISK AVERSION

The US Dollar may continue to suffer against its low-yielding, G10 counterparts as the interest rate gap between the Greenback and its partners narrows. The Federal Reserve’s unexpected 50 basis point rate cut plunged USD, and growing expectations of future easing may continue pressuring the world’s reserve currency.

The upcoming US nonfarm payrolls (NFP) data may catalyze another selling bout in USD-crosses if the statistics underwhelm and reinforce investors’ fear of a global slowdown after a brief interim of stabilization. Analysts are expecting for 175k new jobs for February, 50k lower than the previous release. However, there is concern that the impact from the coronavirus may have undermined job creation for the month.

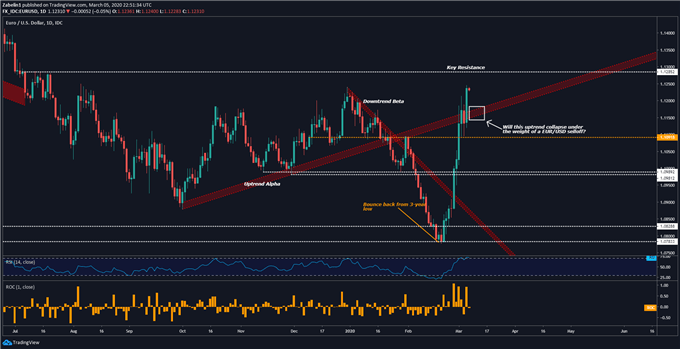

EUR/USD PRICE CHART

EUR/USD is shy less than half a percent of retesting the July 2019 high at 1.1285 after breaking above the former uptrend (labelled as “Alpha”). Clearing the multi-month ceiling may inspire another buying spree if it inspires hope for additional upsides gains. Conversely, capitulation could lead EUR/USD to retest the former uptrend which, if broken opens the door to test support at 1.1091.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

US DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter