JAPANESE YEN, CORONAVIRUS, APPLE, WALMART – TALKING POINTS:

- Yen leads anti-risk currencies higher as stocks fall on Apple warning

- Walmart earnings in focus as markets gauge coronavirus headwinds

- UK labor market figures, German ZEW survey headline data docket

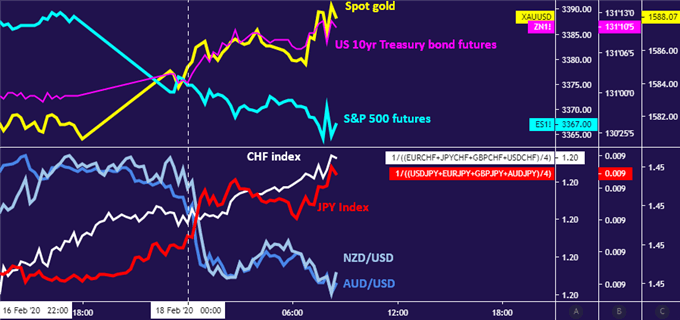

The major currencies echoed broader turmoil across financial markets after Apple Inc said that it would miss its quarterly revenue forecast courtesy of disruptions from the Wuhan-strain coronavirus outbreak. The cycle-sensitive Australian and New Zealand Dollars tracked regional shares lower while the anti-risk Japanese Yen, Swiss Franc and US Dollar outperformed.

Chart created with TradingView

Futures tracking key European and US stock index benchmarks are pointing sharply lower before the opening bell in London and New York, suggesting more of the same is on the horizon. The fourth-quarter earnings report from retail powerhouse Walmart Inc. Many of its suppliers are China-based, so the guidance on offer might offer market-moving insight into the virus’ impact on overall economic activity.

UK labor market data is first in focus on the European data docket. Leading surveys suggest the overall picture saw modest improvement in January. Furthermore, UK data outcomes have notably firmed relative to baseline forecasts recently, suggesting analysts’ models may be underrepresenting the economy’s vigor. If this translates into an upside surprise, the British Pound may rise as BOE rate cut bets fizzle.

The German ZEW survey of investor confidence is also on tap. A bit of a pullback is expected in January after the forward-looking sentiment index hit a 4-year high in the prior month, which seemed to owe mostly to the “phase one” US-China trade deal. The Euro might overlook the release considering it will not capture coronavirus considerations nor carry substantial weight in forecasting ECB policy.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter