EUR/USD Analysis, Jerome Powell Testimony – Talking Points

- EUR/USD decline may be extended if Powell testimony cools 2020 Fed easing bets

- New Zealand Dollar spiked on RBNZ rate decision, unexpectedly hawkish outlook

- EUR/USD continues to fall under descending resistance as it tests September-lows

ASIA-PACIFIC RECAP: RBNZ RATE DECISION, NEW ZEALAND DOLLAR REACTION

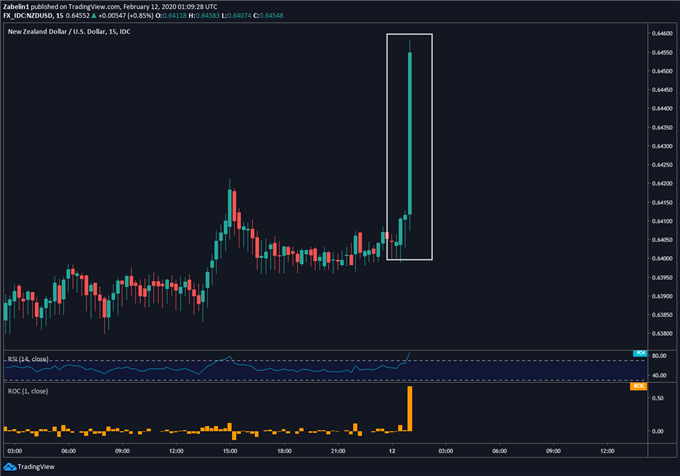

The New Zealand Dollar spiked after the Reserve Bank of New Zealand announced it will hold rates at 1.00 percent and gave an unexpectedly hawkish outlook. Monetary authorities said they do not forecast another rate cut for 2020 and hinted that they may start raising rates in mid-2021. While they anticipate for the coronavirus to impact the economy, the RBNZ expects it will only be for a short duration.

NZD/USD – 15-Minute Chart

NZD/USD chart created using TradingView

POWELL TESTIMONY

On February 11, Fed Chairman Jerome Powell testified to the House Financial Services Committee where he spoke about monetary policy and threats facing the US economy. Most notably, this includes the coronavirus and its unknown impact on China and the reverberation it may have on the US. Mr. Powell also mentioned that officials are closely monitoring the leveraged loan market and the “triple-b” cliff in corporate debt.

The latter has become an increasingly more mainstream topic as investors and policymakers contend with the notion that a downturn half as severe as the one in 2008 could put $19 trillion worth of debt at risk of default. These so-called leveraged loans are being securitized into high-yielding CLOs which have thrived in an environment of low interest rates and eager investors looking to meet their growth targets.

While these risks remain at the forefront, the Chairman praised the US economy saying it is in a “very good place” and saw no reason why the expansion cannot continue. He also addressed concerns about the impact of the coronavirus but reiterated that it is too early to tell what the impact will be on China and the US. After his testimony, overnight index swaps showed a slightly smaller chance of easing in the year ahead.

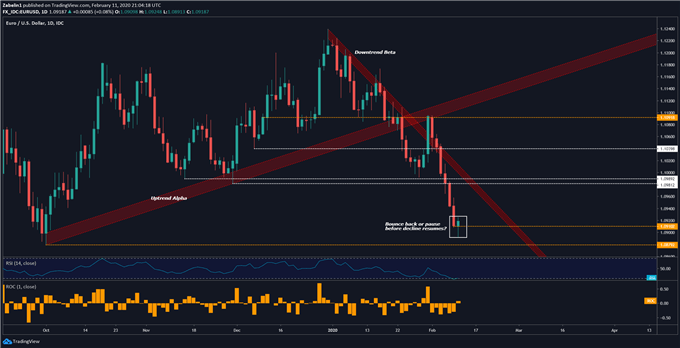

EUR/USD TECHNICAL ANALYSIS

Since December 31, EUR/USD has declined over 2.50 percent and is now hovering at the September-low at 1.0910. This came after the pair encountered some downside friction at 1.0981 before EUR/USD decisively closed lower and continued its descent. Recent price action suggests the pair may attempt to nurse its losses but fundamental catalysts – like Powell’s testimony – may further pressure EUR/USD.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EUR/USD TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter