US Dollar Outlook, Nonfarm Payrolls Preview, Fed Monetary Policy – Talking Points

- USD could rise if NFP data beats forecasts and cools Fed rate cut bets

- Despite rising number of coronavirus cases, markets appear indifferent

- US Dollar index re-saddles January uptrend, but gains may be limited

ASIA-PACIFIC RECAP

Asia-Pacific equities were mixed with the anti-risk Japanese Yen showing modest gains against all its major counterparts while the cycle-sensitive Australian Dollar lagged. The New Zealand Dollar was unimpressed by the RBNZ 2 year inflation expectation result of 1.93 percent despite it being higher than the prior 1.80 percent figure.

US DOLLAR FORECAST AHEAD OF NFP

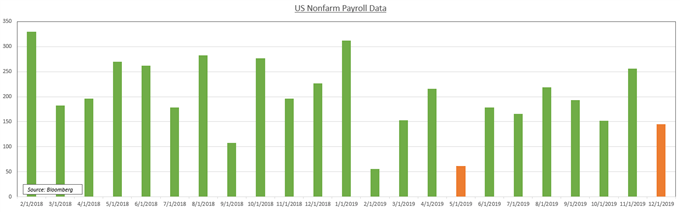

The US Dollar may get a tailwind from better-than-expected nonfarm payroll data if the report beats the 160k forecast. The prior print of 145k was somewhat of a disappointment since it marked the weakest rate of job creation since May. While manufacturing has shown signs of recovery as part of a broader trend of global stabilization, a tight labor market and confident consumer are crucial columns supporting the US economy.

This data release in particular will be heavily scrutinized not only because of its ability to influence Fed monetary policy expectations but also due to next week’s docket involving Chairman Jerome Powell. The head of the central bank will be giving two congressional testimonies with the House Financial Services committee and the Senate Banking Committee. Learn more about other major event risks here!

US DOLLAR TECHNICAL ANALYSIS

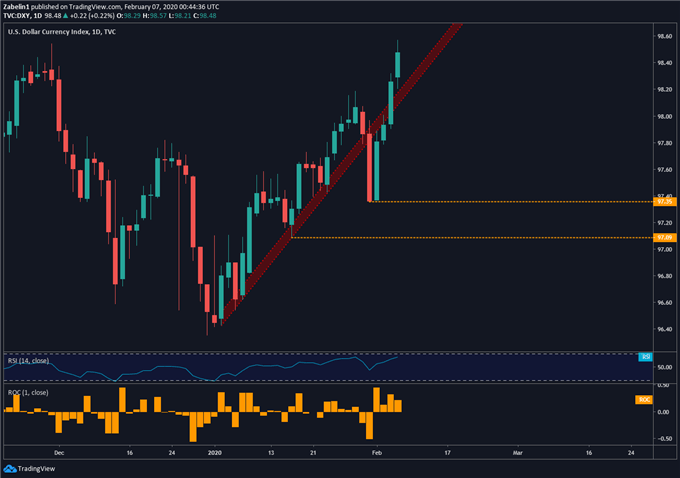

The US Dollar index (DXY) has re-mounted the January uptrend after briefly breaking it and bouncing back from support at 97.35. However, upside gains may be relatively limited with negative RSI divergence showing fading upside momentum as it tests November 2019-highs. Going forward, traders will be keen to see if DXY breaks the steep trend and the severity of a potential selloff.

US Dollar Index – Daily Chart

US Dollar index chart created using TradingView

US DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter