Euro, US Dollar, EUR/USD – Talking Points

- US Dollar could rise if Core PCE data reinforces Fed’s neutral position

- Trade war optimism may continue to buoy market mood, cool easing bets

- EUR/USD may trim recent gains as pair struggles to trade above 1.1121

US Dollar Outlook

The US Dollar may edge lower along with Treasuries if Core PCE data shows stronger-than-expected price growth for November. The final reading for quarter-on-quarter GDP data on an annualized basis is expected to remain unchanged at 2.1 percent, though PCE data will likely command more attention. However, sour US-China trade developments could curb some of the Greenback’s gains if it inflames Fed rate cut expectations.

US Economy Outlook

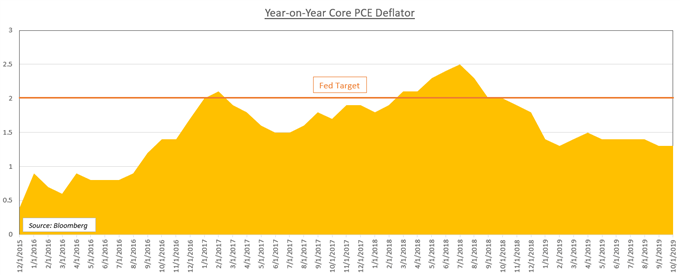

Year-on-year Core Personal Consumption Expenditure data is expected to show a 1.5 percent increase for November, slightly lower than the previous 1.6 percent print. Its quarter-on-quarter equivalent is expected to remain unchanged at 0.1 percent. This particular economic indicator carries an inordinate amount of weight in market attention due to it being Fed’s preferred measure of inflation.

While one publication cannot by itself completely reverse monetary policy, continuous outperform could tilt Fed officials to become more hawkish. Mind you, Chairman Jerome Powell made it very clear at the last meeting that the Fed intends on remaining neutral unless downside risks become materially worse. Conversely, policymakers also said would only consider a hike if inflation remained persistently high.

US-China Trade War

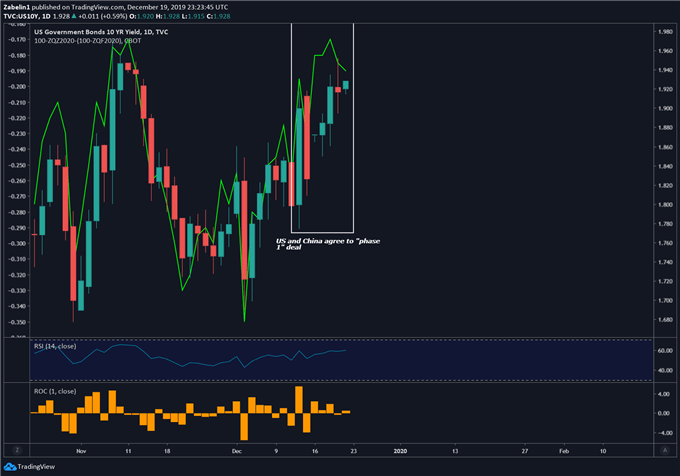

US-China trade relations are still fundamentally unresolved, but the completion of the “phase 1” accord has lifted market sentiment and caused Treasuries yields to climb and cooled 2020 rate cut bets. While Beijing has expressed trepidation in the volume of agricultural purchases, it appears to have been largely ignored by markets. However, if a larger obstacles appear down the road, easing expectations may build at the expense of USD.

US 10-Year Government Bond Yield, Federal Funds Futures December-January 2020 Contracts

US government bond yield chart created using TradingView

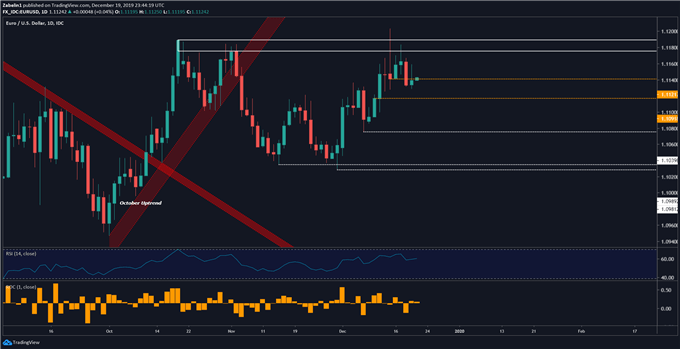

EUR/USD Technical Analysis

After briefly reaching above the 1.1182-1.1165 resistance range, EUR/USD quickly retreat and has struggled to climb higher. The pair is now hovering just on the cusp of 1.1121, though recent price action suggests upside resolve is waning. Looking ahead, the pair may retest 1.1091, which, if broken could open the door to support at 1.0989.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

US DOLLAR TRADING RESOURCES

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter