Euro Outlook, EUR/USD Technical Analysis, Trade Wars – Talking Points

- Euro may face selling pressure if local PMI data reinforces regional slowdown concerns

- Escalating EU-US trade tensions could magnify Euro selloff and fuels ECB rate cut bets

- EUR/USD recovery may be short-lived despite biggest one-day surge since September 17

Learn how to use politicalrisk analysis in your trading strategy !

Asia-Pacific Recap

The Australian Dollar edged modestly lower following the publication of local GDP data. Year-on-year growth remained unchanged at 1.7 percent, though on a quarter-on-quarter basis the economy only grew 0.4 percent, missing the 0.5 percent forecast. APAC equities moved cautiously lower as tensions between the US and China heat up over the passage of the Hong Kong Humans Rights and Democracy Act.

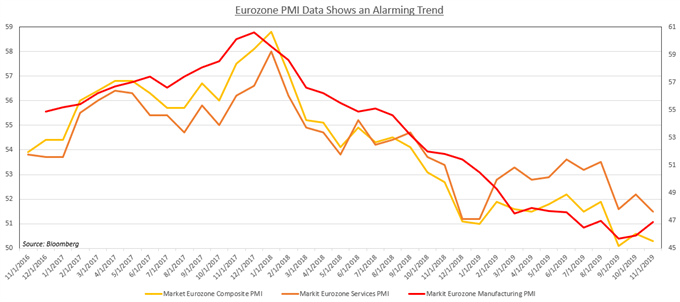

Eurozone PMI

The final print for Eurozone services and composite PMI is expected to show a 51.5 and 50.3 reading, respectively. Weak manufacturing data in Europe – particularly Germany – has dragged the composite lower while services remains relatively resilient. However, this is not a trend specific to Europe; all over the world manufacturing has been enduring an industrial recession in large part due to the US-China trade war.

Note: A print below 50 indicates a contraction

If Eurozone services PMI data shows that the contagion of the industrial slowdown is now infecting another sector of the economy, it may prompt a Euro selloff if the statistics inflame the urgency for ECB rate cuts. The region is already struggling with Brexit – though the potency of that risk is waning– and a brewing trade dispute with the US may further dampen the Eurozone’s economic outlook.

US-EU Trade Tensions

The EU and US are once again at each other’s throats after US President Donald Trump proposed a multi-billion dollar tariff against the EU in response to France’s digital tax. The levies would target French goods ranging from porcelain to cheese. European policymakers have said they are ready to retaliate against the US if necessary, raising the risk of resurrecting what was thought to be a dead cross-Atlantic trade dispute.

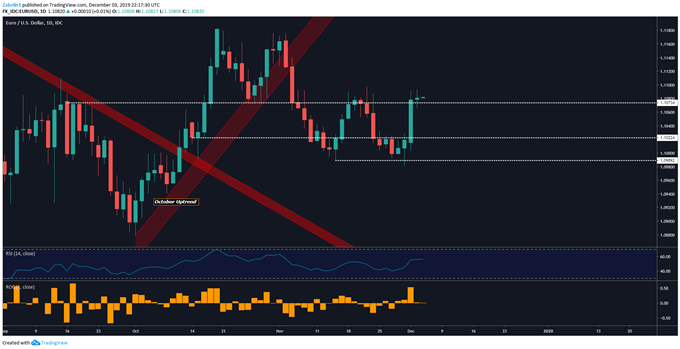

EUR/USD Technical Analysis

On December 2, EUR/USD rallied over 0.50 percent, reclaiming lost ground from the late-November selloff. It also marked the largest one-day rise since September 17. The pair is now hovering slightly above former resistance-now-turned-support at 1.1073. However, upside momentum may be curbed by the upcoming fundamental catalysts. In the next few days, EUR/USD may re-enter the 1.1022-1.1073 congestive zone.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter