Euro, EUR/USD, Eurozone Economic Data– Talking Points

- Euro may fall if Eurozone confidence data spooks markets

- Market volatility may be amplified by German CPI report

- EUR/USD on verge of breakdown as it approaches 1.0989

Learn how to use politicalrisk analysis in your trading strategy !

The Euro may fall if Eurozone confidence data underscores a gloomy spirit in consumers and businesses amid the regional slowdown. German CPI may also amplify a Euro selloff if the statistics show weakening price growth out of Europe’s largest economy following this week’s unnerving IFO data. From a technical perspective, EUR/USD may be on the verge of breaking key support that may catalyze an aggressive selloff.

Confidence is Key: How European Consumers, Businesses Are Feeling

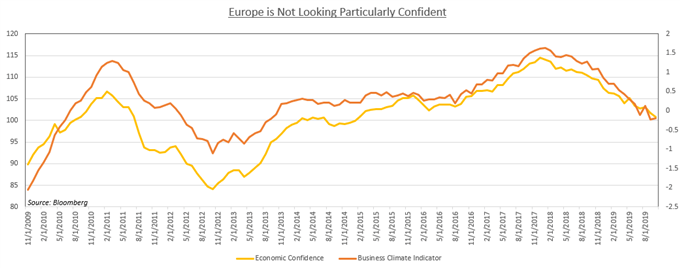

Amid the regional slowdown from both internal political strife and unresolved structural issues and external risks, Eurozone consumer and business confidence has been waning. The various sentiment indicators are all lingering at five-year lows, which at that point in time was around the period of the Eurozone debt crisis. While the region is not embroiled in that degree of turmoil, there are certainly many factors that could lead it there.

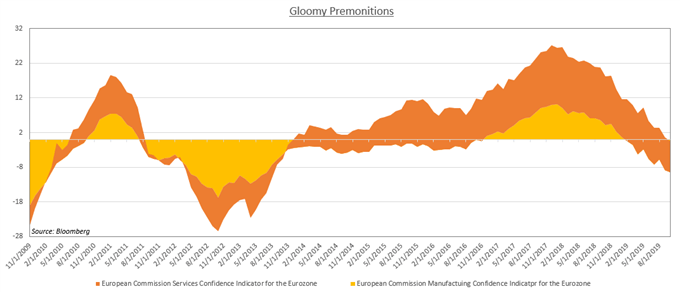

Manufacturing in particular has been suffering in large part from the US-China trade war that has plunged the world into an industrial “recession”. The relatively resilient labor market has managed to keep the contagion of the manufacturing slowdown at bay, though officials fear a spillover could severely impair growth. Looking ahead, traders will continue to monitor these reports against the backdrop of escalating EU-US trade tensions.

EUR/USD Technical Outlook

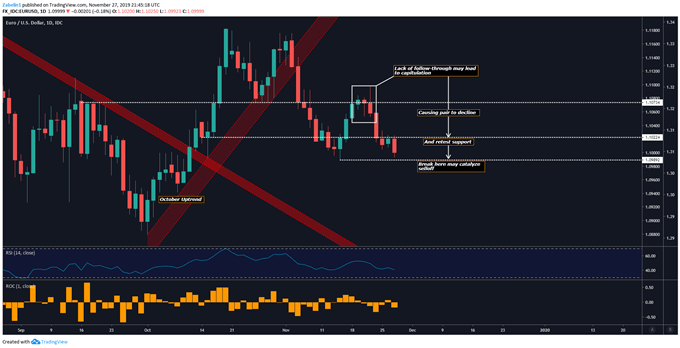

EUR/USD has retraced approximately half of the gains it has acquired during the October uptrend. The next key price level to monitor will be support at 1.0989. The pair is currently hovering just below support-now-turned resistance at 1.1022, a key price level I have been watching for a little over a week. A break below 1.0989 could precede a selloff and further undo EUR/USD’s progress in the prior month.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter