Euro Price Chart, Eurozone Economy – Talking Points

- Euro may extend decline if Eurozone data unnerves investors

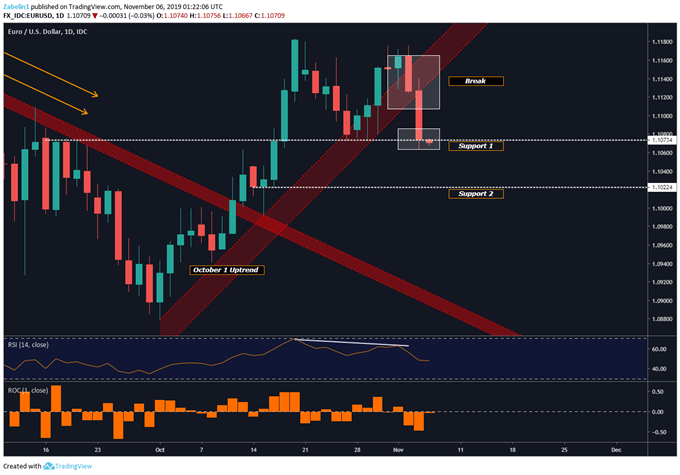

- EUR/USD downtrend may accelerate after pair broke uptrend

- Revived market optimism could help improve economic reports

Learn how to use politicalrisk analysis in your trading strategy !

The Euro’s decline may accelerate vs the US Dollar if Eurozone PMI, retail sales and Germany factory orders data reinforces fears about the Eurozone’s growth prospects. The Greenback strengthened in the previous session after US composite services data beat forecasts and cooled December rate cut bets from the Fed. If Eurozone data misses and saps capital from the Euro, EUR/USD may look to test support at 1.1022.

Since September 2018, economic data out of the Eurozone has been tending to underperform relative to economists’ expectations despite a brief improvement between March and June of 2019. Internal political strife and Brexit negotiations have taken their toll on the region’s growth prospects. However, a cool down in cross-Atlantic trade tensions and improvement in US-China economic relations has helped improve sentiment.

A month-on-month timeframe, Eurozone retail sales for September are expected to show no growth while an annually-calculated interval has them pegged at 2.4 percent. PMI services data is expected to print modestly above the 50.0 mark while its manufacturing counterpart remains in contractionary territory. This is not specific to the eurozone; all over the world industrial production has been significantly slowing.

This in large part has to do with the US-China trade war, though if relations continue to thaw it could help the manufacturing sector recover. Germany – the largest economy in the Eurozone and the world’s third-largest exporter – is expected to show year-on-year factory orders contract again by 6.3 percent. Because of the sheer size of the Germany economy – relative to its EU peers – its economic data is frequently watched with more scrutiny.

EUR/USD Forecast

As forecasted, EUR/USD broke below the October uptrend as negative RSI divergence pointed to slowing upside momentum. The pair is now hovering at the 1.1073 support level and may test another floor below it at 1.1022 if the pair’s descent continues. Traders may wait for the pair to clear the second layer of support before they add onto their short positions.

Market Analysis of the Day: EUR/USD Spots Next Later of Support?

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter