US Dollar Outlook, Nonfarm Payrolls Data – Talking Points

- The US Dollar may extend decline if PMI reports, jobs data misses

- Pro-risk environment leaves Greenback exposed to selling pressure

- Poor data may fuel rate cut bets despite Powell’s recent comments

Learn how to use political-risk analysis in your trading strategy !

The US Dollar may extend its decline if nonfarm payrolls data and critical PMI reports bolster the case for accommodative monetary policy. After Wednesday’s FOMC rate decision, Fed Chairman Jerome Powell signaled that the Fed will pause on its rate cutting spree and but will continue to monitor data. However, chronic underperformance in key indicators may pressure the Fed to adopt more accommodative measures.

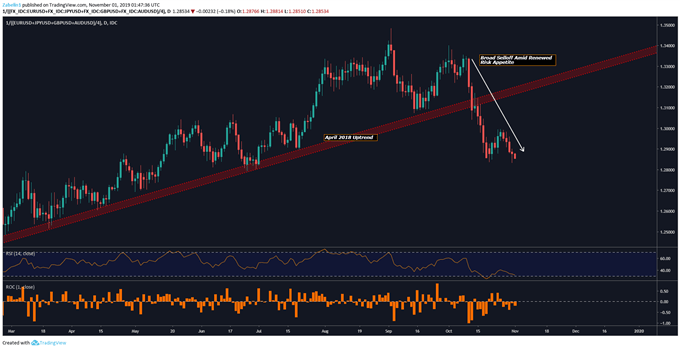

The revival of a cautious risk-on tilt in market sentiment has recently left the US Dollar in the proverbial dustbin as traders shifted from prioritizing liquidity to chasing returns. This might explain why the US Dollar has been the third-worst performing G10 currency against the Euro since October 10. Meanwhile, the third and second highest spot returns have come from the pro-risk Swedish Krona and Australian Dollar.

Market buoyancy has in large part come from the ethereal improvement in geopolitical relations like the US-China trade war – which, might actually be in jeopardy of falling apart sooner than expected – and increased liquidity provisions from central banks all over the world. As a result, this has eased the demand for haven-linked assets that was the driving force behind the US Dollar’s ascendency for all 2018 and most of this year.

However, if underlying fundamentals continue to erode, they could eventually shatter the shallow veneer of certainty markets have been so desperately clinging to and could lead to a revived interest in the US Dollar. Demand for liquidity would likely be the biggest culprit behind the Greenback’s ascendancy in that particular instance. However, for now it appears USD is in proverbial hibernation until market conditions wake it up.

Market Analysis of the Day: US Dollar Suffers as Market Sentiment Improves – But for How Long?

US Dollar chart created using TradingView

US DOLLAR TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter