IMF Update, FOMC Minutes, US Dollar, Euro Outlook

- US Dollar may rise vs Euro if FOMC minutes cool rate cut bets

- Risk averse environment may be amplified by the IMF’s report

- Combined, these factors could help push the US Dollar higher

Learn how to use political-risk analysis in your trading strategy !

The US Dollar may rise vs the Euro if the FOMC meeting minutes pour cold water over ultra-aggressive Fed rate cut bets against the backdrop of potentially sour news from the IMF. The latter may amplify risk aversion and place a premium on anti-risk assets and drive traders to flock to the highly-liquid US Dollar. Escalation in US-China trade war developments may also be a tailwind for haven-linked assets like JPY and CHF.

On October 8, Fed Chairman Jerome Powell gave a few remarks at the NABE conference in Denver. The overarching message was that the Fed is still data-dependent and will monitor incoming data and adjust policy accordingly. However, he did cite global developments posing a risk to the favorable US economic outlook and gave a special nod to rising geopolitics risks as a factor impacting policy.

Furthermore, on October 8, the newly-appointed IMF Director Kristalina Georgieva warned of a “synchronized slowdown”, citing trade war uncertainty as a major headwind to global GDP. She added that “growth this year will fall to its lowest rate since the beginning of the decade” and expressed concern about the global impact of the disruption of cross-border supply chains.

Read more about the ongoing trade war within Asia between two key US allies.

The crisis-lender will also be publishing an update to its World Growth Outlook report, specifically updates its analytics chapter that macro-fundamental investors may be paying attention to. This will also be occurring against the backdrop of escalating US-China trade tensions after Washington threatened to blacklist several Chinese companies for human rights violations. Chinese officials then stated to “stay tuned” for retaliation.

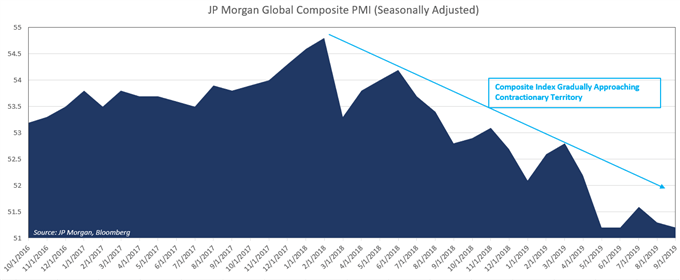

Market Analysis of the Day: Global Composite PMI Data Shows an Alarming Trend

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter