US Dollar, Euro, Trade War Outlook

- Euro, US Dollar closely eyeing Eurozone PMI, US ISM data

- US-EU trade war tensions may erupt from the WTO ruling

- How will EU revive growth with interest rates at low levels?

Learn how to use political-risk analysis in your trading strategy !

EUR/USD traders brace for what could be a volatile session ahead of the release of critical US ISM and Eurozone CPI data against the backdrop of tense EU-US trade relations. This week, the WTO is set to decide to what degree the US can retaliate against the European Union after a panel found them guilty of subsidizing aircraft giant Airbus. Washington has expressed it will retaliate accordingly to the fullest extent.

This may include an over-$7 billion tariff on EU-imported goods. Learn more about how the US Dollar and Euro might perform in a cross-Atlantic trade war!

While Brussels may be eager to levy tariffs in response to their complaint of the US illegally supporting Boeing, Europe will have to wait until 2020 to see what degree they are allowed to retaliate. Europe is already struggling with geopolitical risk from Brexit and slower regional growth against the backdrop of US-China trade tensions. A trade war with the US may pressure local member states to implement aggressive fiscal measures as the potency of monetary policy wanes.

Using a year-on-year timeframe, Eurozone CPI is expected to show an advanced reading for September of 1.0 percent, while manufacturing PMI is expected to remain unchanged at 45.6. Sustained price growth in Europe is increasingly looking like an uphill battle with the 5Y5Y Euro Inflation Swap Forward hovering at its lowest point ever on a month-by-month basis.

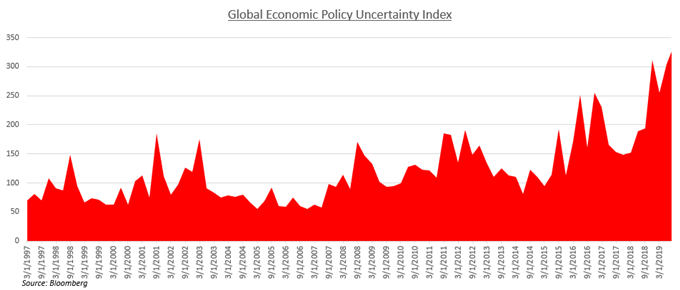

In the US, manufacturing data and construction spending will be crucial to monitor as the US-China trade war continues to undermine business confidence and investment. The trade conflict continues to be a major point of uncertainty and a tailwind for manufacturers who fear increased tension is leading to waning demand. While US exports account for a small portion of GDP, the sentiment-souring nature of the trade war has a larger impact on overall consumption and future business expansion.

Chart of the Day: Uncertain Times Leaves Traders Worried About Future Growth Prospects

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter