US Dollar Outlook, Euro, US-EU Trade War – TALKING POINTS

- US Dollar may rise vs Euro if trade tensions spook markets

- Eurozone continues suffering from slower regional growth

- German unemployment data may also pressure the Euro

Learn how to use political-risk analysis in your trading strategy !

The US Dollar may extend gains against the Euro if US-EU trade war tensions escalate and cause traders to rush into the open arms of the highly-liquid Greenback. The dispute is over a decade old and comes from allegations that the EU has been illegally subsidizing the European-based aircraft giant Airbus. However, Brussels also has a similar complaint; only its against Boeing over a similar accusation of illegal US subsidies.

Sources close to the matter have indicated that the ruling will likely tilt in favor of the US, in which case Washington may impose multi-billion Dollar tariffs on European goods. The products range from airplane parts to luxury items in clothing and wine. However, Brussels may also retaliate by imposing its own levies on US goods approximating $14 billion.

With tensions already strained, Washington may use a familiar tactic and threaten to impose auto tariffs against its European partner. Germany’s export-heavy DAX would likely plunge amid slower regional demand against the backdrop of fading global growth. At the time of writing, the benchmark German equity index is almost 10 percent below its 2018 peak at around 1357.

Germany’s economy has been dubbed the “steam engine of Europe” so when economic data there is published, it typically is heavily scrutinized because of the implication it has for regional growth prospects. German unemployment change is estimated to clock in at 5.0k, slightly higher than the previous 4.0k print. The unemployment claims rate is expected to remain unchanged at 5.0 percent.

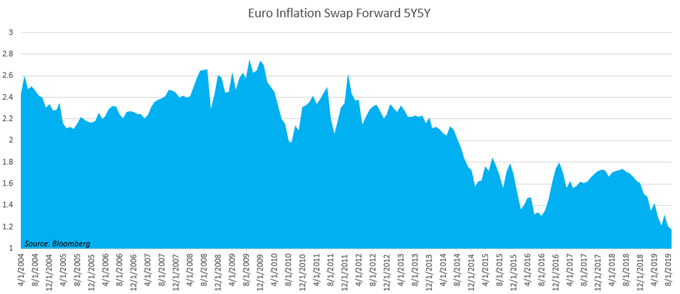

If key German data underperforms and EU-US trade tensions escalate, EUR/USD may fall as demand for liquidity will push the Greenback higher at the expense of the Euro. Inflationary prospects for the Euro remain dismally low with the 5Y5Y Euro Inflation Swap Forward now at its lowest point ever on a month-on-month basis at 1.1775.

Chart of the Day: Inflation is Not Looking Great for the Eurozone

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter