ECB, Euro, US Dollar – TALKING POINTS

- Markets closely watching ECB President Mario Draghi hearing

- EU parliament will ask him about monetary policy, his outlook

- Swiss Franc may rise vs Euro if his commentary spooks markets

Learn how to use political-risk analysis in your trading strategy !

The Swiss Franc may rise alongside German Bunds if during the EU Parliamentary hearing, ECB President Mario Draghi spooks financial markets. The soon-to-be replaced chief will be speaking about monetary policy and his outlook for economic growth. He will be officially replaced in October by former IMF Director Christine Lagarde who has signaled she will closely follow Mr. Draghi’s footsteps.

At the most recent ECB meeting, the central bank lowered the deposit facility by 10 basis points to -0.50 percent and reintroduced their bond-purchasing program after attempting to wean markets off of ultra-easy credit conditions. Upon the announcement, the Euro rallied, signaling that investors’ yearning for liquidity suggests market participants are panicking about the Eurozone’s economic prospects.

Furthermore, the publication of Eurozone flash PMIs will be on everyone’s radar in light of the region’s chronic weakness. Germany’s economy – the proverbial steam engine of Europe – shrunk 0.1 percent in the second quarter, and Chancellor Angela Merkel has stated that they will not deficit spend. However, they will have to think of new creative ways to revive growth with interest rates in negative territory and QE already in place.

Euro traders – especially those trading it against the British Pound – will also be closely watching the UK Supreme Court ruling on whether or not Prime Minister Boris Johnson’s suspension of parliamentary was legal. If the judges rule it as unlawful, it could complicate his Brexit negotiations – and possibly even his tenure as PM.

See my EUR/GBP technical forecast here for more!

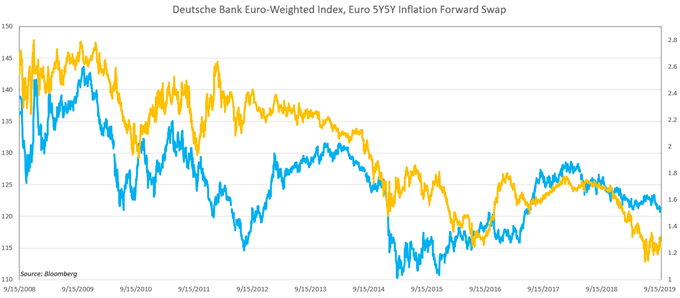

Chart of the Day: Inflationary Prospects for Euro Shows a Gloomy Picture

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter

.jpg)