EUR/USD, US NFPs, US Dollar – TALKING POINTS

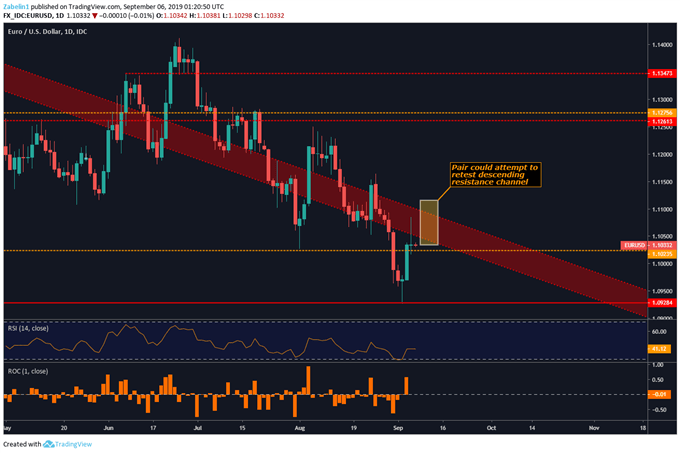

- EUR/USD may re-enter 18-month descending resistance channel

- A poor print of US nonfarm payrolls data may be a key catalyst

- Premium on liquidity may return if political détentes deteriorate

Learn how to use political-risk analysis in your trading strategy !

EUR/USD may suffer if US nonfarm payrolls data misses the 160k growth estimate for August. An underperformance in this report could bolster the case for the Fed to implement accommodative policy measures and would likely be reflected in overnight index swaps. As it stands, market participants are already pricing in a better-than-even chance of a 50 basis-point cut in October.

However, given what Fed Chairman Jerome Powell had said at the Jackson Hole symposium and recent comments by some of the more cautious central bank members, officials are not as dovish as many believe they are. As such, market participants may – once again – be setting themselves up for disappointment if the Fed conveys a less-dovish outlook than what investors are pricing in.

EUR/USD’s rebound from a two-year low comes as demand for haven assets – like the US Dollar – is declining amid the emergence of ethereal market optimism. An uplift in sentiment from political détentes in Italy, cooling US-China trade war tensions and a reduction in fears of a no-deal Brexit have put recessionary concerns and yield curve inversions on the back-burner.

However, those concerns may quickly resurface as the fragile mosaic of political stability shatters under the weight of its own almost-inevitable disintegration. Under these circumstances, data that fuels rate cut expectations may continue to pressure US Dollar crosses until the urgency for liquidity and anti-risk assets makes a reprise and causes EUR/USD to resume its dominant downtrend.

Chart of the Day: EUR/USD May Look to Retest Descending Resistance Channel

EUR/USD chart created using TradingView

EUR/USD TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter