US Dollar, Euro, Jackson Hole, Eurozone PMIs – TALKING POINTS

- Euro may fall vs. US Dollar if ECB minutes evoke ultra-dovish expectations

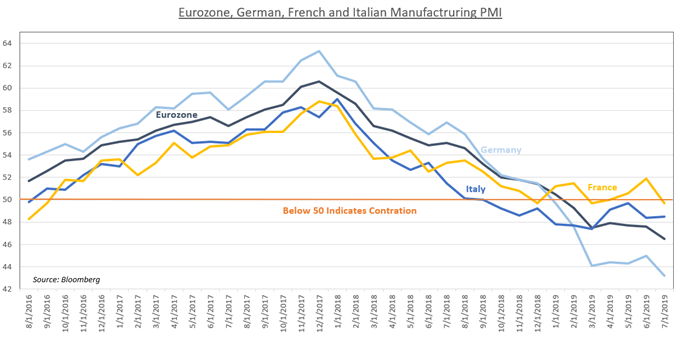

- Eurozone PMIs may exacerbate regional growth fears and undermine Euro

- Official commentary on growth outlook at Jackson Hole may spook markets

Learn how to use political-risk analysis in your trading strategy !

The Euro may suffer against the US Dollar if the release of the ECB minutes reveal stronger-than-expected dovish inclinations against the backdrop of Eurozone PMI publications. Regional growth concerns have been mounting as Germany – Europe’s largest economy – is expected to show a contraction in Q2. Comments from officials at the Jackson Hole symposium may also stoke growth fears and boost the anti-risk USD vs the Euro.

Jackson Hole Symposium

Markets will be closely watching the Jackson Hole symposium for comments from officials regarding the growth outlook. The release of the FOMC meeting minutes revealed that trade war concerns remain a “persistent headwind” and low inflation remain key obstacles along with corporate debt and leveraged lending. The latter has begun to sound the alarm as the collateralized loan obligation market stirs familiar fears.

European Growth Concerns, Political Instability

If comments from the Jackson Hole symposium carry overwhelming undertones of uncertainty, the Euro may fall against its US Dollar counterparts. EURUSD’s decline may be amplified if Eurozone PMI data reinforces the fear that the Eurozone is significantly decelerating in its growth prospects. As it stands, Germany is planning on implementing stimulative policies as a contingency for a crisis ahead.

Europe is also dealing with chronic political upset in both the mainland and overseas. The latter is referring to the ongoing Brexit negotiations that remain unclear despite the October 31 deadline approaching. Italian political volatility and another possible budget dispute in the same month may magnify market volatility. During times of economic uncertainty, the capacity for political shocks to disrupt markets is notably increased.

CHART OF THE DAY: Weak European Manufacturing PMI May Spill Over into Services Soon

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter