US DOLLAR, ECB, EURUSD – TALKING POINTS

- US Dollar may gain vs Euro if Eurozone inflation data misses forecasts

- Weak price growth may push Euro lower if ECB rate cut bets increase

- EURUSD downtrend may accelerate from the ECB and FOMC minutes

Learn how to use political-risk analysis in your trading strategy !

The US Dollar may extend gains vs the Euro if Eurozone inflation data misses estimates and boosts ECB rate cut bets and the prospect of the central bank reintroducing quantitative easing. Economic data out of the Eurozone has been tending to underperform relative to economists’ expectations. Last week, preliminary German GDP data showed that Europe’s largest economy likely contracted in the second quarter.

A week before that, German ZEW Survey Expectations came in at -44.1. The last time the data hovered at those levels in the past ten years was during the 2008 financial meltdown and the Eurozone debt crisis. If the “steam engine of Europe” continues to slow down, weaker demand will begin to ripple out into other member states and undermine regional price growth.

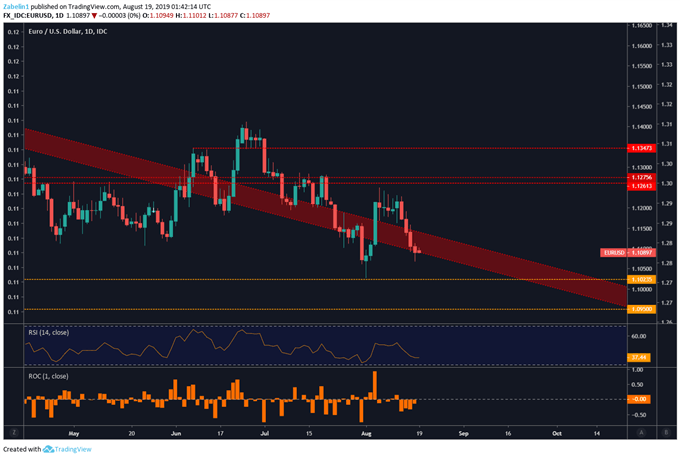

EURUSD Technical Analysis

EURUSD is hovering around the lower lip of 16-month descending resistance with a possible floor at 1.1023. A break below this support level with follow-through could trigger a selloff until it hits 1.0950. Looking ahead, Eurozone inflation data may push the pair lower, though the real catalysts for significant price moves will likely be the publication of the ECB and FOMC meeting minutes.

CHART OF THE DAY: EURUSD Aiming at Key Support Level?

EURUSD chart created using TradingView

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter