TALKING POINTS – EURUSD FORECAST, US ECONOMIC DATA, GBPUSD, MARKEY CARNEY, BOE

- Growing risk aversion putting premium on liquidity, fueling demand for USD

- Even if US econ data underperforms, demand for haven may buoy Greenback

- GBP will be watching Bank of England Governor Mark Carney’s commentary

See our free guide to learn how to use economic news in your trading strategy !

APAC RECAP

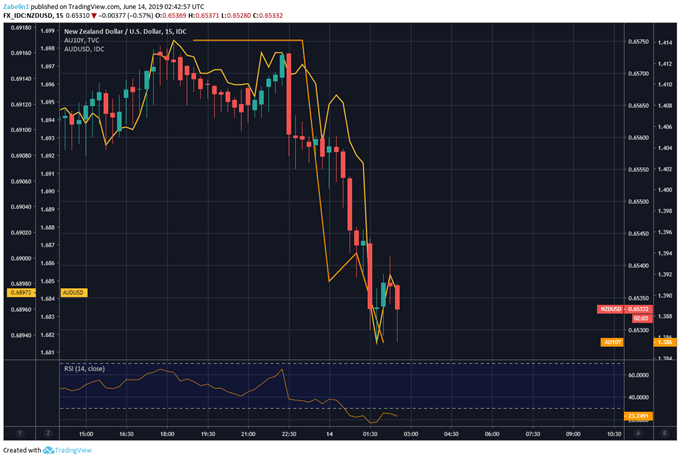

Asia Pacific markets found themselves shaken after a series risk-aversion-inducing catalysts crossed the wires within a relatively short time frame. New Zealand PMI data showed a significantly smaller expansion compared to April and sent NZDUSD lower which was later followed by a decline in AUDUSD and Australian government bond yields. The latter appears to have come as a result of increased speculation of another rate cut by the RBA.

GROWING RISK AVERSION FUELING DEMAND FOR LIQUIDITY OVER RETURN?

Growing risk aversion in financial markets may distort typical reactions FX markets have to data releases. In the US, retail sales and sentiment data may push EURUSD higher if both publications show a weaker reading. An underperformance in the data would not be surprising considering that the recent publication of CPI showed that momentum for price growth is slowing.

In times of risk aversion, investors typically put a premium on liquidity over returns and frequently flock to anti-risk assets like the US Dollar and Treasuries. In this case, if economic data shows weakness, it will reinforce the narrative of the doves that looser credit conditions are becoming increasingly necessary. Usually, this would result in a weaker Greenback and lead to an exodus of capital in USD as we’ve seen recently seen.

However, since the economic circumstances appear more dire now relative to before, a dovish shift in the Fed may not actually result in a weaker Dollar. This is because market participants may question why the central bank is cutting rates. The inevitable conclusion is that prevailing economic conditions are bad enough that policymakers felt compelled to lower interest rates. In times of crisis, where do investors typically flock?

To haven assets! The quintessential one of which is the US Dollar.

Meanwhile, GBP will be closely watching Bank of England Governor Mark Carney’s speech in London. If any messages within the commentary allude to a deterioration in the economic outlook, it could amplify the effect of risk aversion and cause even more capital to fly into the arms of the US Dollar. GBPUSD may find itself under additional pressure as the race for Prime Minister in the UK continues.

CHART OF THE DAY: NZDUSD, AUDUSD, AUSTRALIAN BOND YIELDS SUFFER

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter