TALKING POINTS – YEN, TRADE WAR, CHINA, US DOLLAR, TARIFFS, TRUMP

- Yen up as APAC stocks follow Wall St. lower, NZD down on RBNZ cut

- US-China trade talks eyed as Beijing bristles at Trump tariff hike threat

- S&P 500 completes bearish chart pattern, signaling risk-off bias ahead

The New Zealand Dollar underperformed in Asia Pacific trading hours after the RBNZ announced a cut of the benchmark interest rate to 1.50 percent. The US Dollar corrected lower as markets digested the prior session’s gains, scored courtesy of haven demand amid a broad-based selloff. The similarly anti-risk Japanese Yen continued higher however as APAC stocks followed Wall Street lower.

Looking ahead,German industrial production figures headline an otherwise muted data European docket. Forecasts envision a 0.5 percent decline in March. Leading PMI data has already telegraphed acute weakness over period in question however, as well as the month to follow. Absent an especially dramatic deviation from baseline projections, this probably undercuts this release’s market-moving potential.

YEN MAY RISE AS CHINA TAKES HARD LINE ON US TARIFF HIKE THREAT

Rather, the spotlight is likely to turn to the coming arrival of a Chinese delegation led by Vice Premier Liu He in Washington, DC for another round of trade talks. The clock is ticking as negotiators scramble to make progress after US President Donald Trump committed to raising tariffs on $200 billion in Chinese imports form 10 to 25 percent this Friday, triggering a market rout.

Rhetoric seeping out from official circles in Beijing suggests policymakers there are not keen to appear timid or deferential as the White House dials up the pressure. That might make for a tense outing between Mr Liu and his US counterparts. Another risk-off sweep is likely if this cools bets on a near-term deal ending immediate hostilities. JPY and USD seem positioned for gains in such a scenario.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

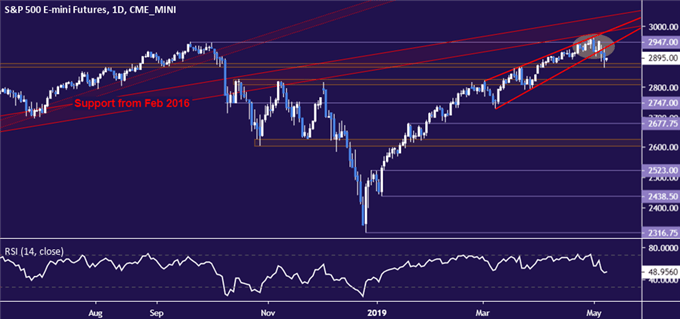

CHART OF THE DAY – S&P 500 COMPLETES BEARISH SETUP, SIGNALS TREND CHANGE

S&P 500 chart positioning is signaling trend change. Prices recoiled from a dense resistance cluster below the 3000 figure, as expected. The subsequent break below the floor of a bearish Rising Wedge chart pattern appears to confirm the formation of a double top, setting the stage for deeper losses ahead.

The bellwetherstock index often serves as a proxy for market-wide sentiment trends. To that end, this reversal might portend a broader risk-off pivot across global financial markets. That bodes well for defensive plays like JPY and USD. Cycle-sensitive commodity dollars (AUD, NZD) might face outsized pressure.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter