TALKING POINTS – CANADIAN DOLLAR, CRUDE OIL, US WAIVERS, IRAN, CHINA, INDIA

- Canadian Dollar up with crude oil on reports US to end Iran sanctions waivers

- Australian and NZ Dollars down as contagion fears stoke broader risk aversion

- US Dollar and Japanese Yen might find support in safety-seeking capital flow

The Canadian Dollar rose alongside crude oil prices, which jumped to a six-month high amid reports that the US is preparing to announce that it will discontinue granting sanctions waivers to countries trading with Iran. The similarly-minded Norwegian Krone was also broadly higher. The oil industry is a standout driver of economic growth in both Canada and Norway.

Broader risk appetite soured in tandem. That probably reflected worries about rising energy prices at a time when global growth seems wobbly as well as fears about the knock-on effects that such a US escalation might have were it to materialize. For example, China is a leading importer of Iranian crude, and canceling its waiver would likely complicate ongoing trade negotiations.

Tensions with other allies may be heightened as well. Japan and South Korea currency have waivers. The US is just starting a round of trade talks with the former having recently recommitted to a free trade deal with the latter. Perhaps most worryingly, a tougher stance from Washington might portend a looming clash with the EU after it set up a framework to circumvent the US sanctions regime.

With this and perhaps fading hopes for further Chinese monetary stimulus in mind, the sentiment-geared Australian and New Zealand Dollars traded broadly lower. Bellwether S&P 500 futures are pointing lower ahead of the opening bell on Wall Street, warning that markets will be returning from the Easter holiday in a downbeat mood. That may buoy the anti-risk Japanese Yen and US Dollar as the day wears on.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

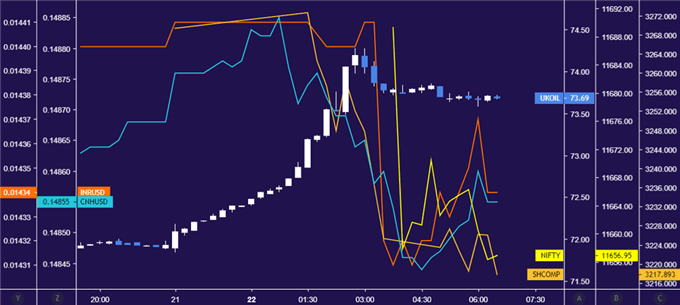

CHART OF THE DAY – STOCKS, CURRENCIES IN INDIA & CHINA PLUNGE AS CRUDE OIL SOARS

India and China are the largest importers of crude oil from Iran. Both countries received US waivers when President Donald Trump opted for withdrawal from a multilateral de-nuclearization deal with Tehran negotiated and implemented by the preceding Obama administration.

The possibility that ending these waivers might stunt growth and sharpen tensions at an already fragile stage in the global business cycle has understandably spooked local assets. India’s NIFTY 50 stock benchmark fell alongside the the Rupee (INR). Shares in China and the offshore Yuan (CNH) followed suit.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter