TALKING POINTS – LYFT, US-CHINA TRADE TALKS, BREXIT, GLOBAL GROWTH

- Hopes for progress in US-China trade talks, Lyft IPO lift market mood

- Another botched Brexit vote, soft economic data may cool risk appetite

- Yen, US Dollar may resume offensive as S&P 500 chart warns of top

The Australian and New Zealand Dollars tracked stocks higher while the anti-risk US Dollar and Japanese Yen backpedaled as sentiment firmed on Asia Pacific bourses. US Treasury Secretary Mnuchin stoked hopes for progress in US-China trade talks and Lyft managed a seemingly strong IPO. The ride-hailing company raised $2.34 billion – coming in at the top end of forecasts – before today’s trading debut.

Futures tracking bellwether US and European stock index futures are pointing higher before London and New York come online, hinting at more of the same ahead. Follow-through may yet fizzle however. Trade war de-escalation has been a flimsy upside catalyst of late, another Brexit vote in the House of Commons may end in stalemate, and incoming economic activity data might stoke global slowdown worries.

The impact of recent upturns in US-China negotiations – like the Trump administration’s shelving of a planned tariff hike on $200 billion in imports – was limited to brief bursts of intraday optimism. Meanwhile in Westminster, a third drubbing for UK Prime Minister May’s EU withdrawal plan would prolong uncertainty and sour the markets’ mood. If Lyft thus falls on its first trading day, so much the worse for sentiment.

On the data front, GDP reports from the UK and Canada as well as US PCE and home sales numbers are in focus. Market participants may painfully reminded of the precarious state of the global business cycle if the results that cross the wires disappoint, echoing the increasingly entrenched tendency for economic news flow to underperform relative to baseline forecasts.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

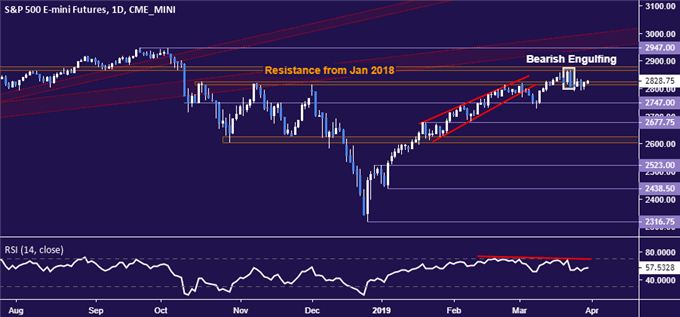

CHART OF THE DAY – S&P 500 SEEMINGLY WAITING FOR A SELLOFF TRIGGER

The bellwether S&P 500 stock index started this week showing an ominous Bearish Engulfing candlestick pattern coupled with negative RSI divergence, warning that a top is forming. Meaningful downside progress has not materialized but prices are tellingly struggling to close back above former support in the 2814-25 area. That may imply that the path of least resistance favors weakness, if only a potent catalyst emerged.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter