TALKING POINTS – EURO, IFO, YEN, US DOLLAR, S&P 500, RISK APPETITE

- G10 FX in digestion mode as APAC stocks follow Wall Street lower

- Yen, US Dollar appear biased higher amid continued risk aversion

- S&P 500 chart positioning hints a major turn in sentiment is ahead

Price action was relatively muted in the G10 FX space at the opening of the trading week even as Asia Pacific stock exchanges swooned, picking up on a negative lead from Friday’s Wall Street session. The anti-risk Japanese Yen and US Dollar edged nominally higher while the sentiment-geared Australian Dollar inched a bit lower. The British Pound was in corrective mode, retracing earlier gains.

Broadly speaking, investors’ dour mood reflects increasingly acute fears about a downturn in global growth. Data flow out of the world’s top economies has increasingly disappointed relative to forecasts recently, cooling risk appetite. Bellwether S&P 500 futures point sharply lower to hint this remains the path of least resistance in the near term, setting the stage for USD and JPY to rise as commodity-bloc currencies suffer.

GERMAN IFO DATA MAY AMPLIFY GLOBAL SLOWDOWN FEARS

The incoming German IFO business confidence survey may encourage more of the same. The headline Business Climate gauge is seen holding steady in March after hitting to a four-year low in February. A disappointment echoing the downbeat tone of regional releases since September 2018 may inspire a dovish shift in the ECB outlook and offer fresh fodder to slowdown fears, hurting the Euro and risk assets alike.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

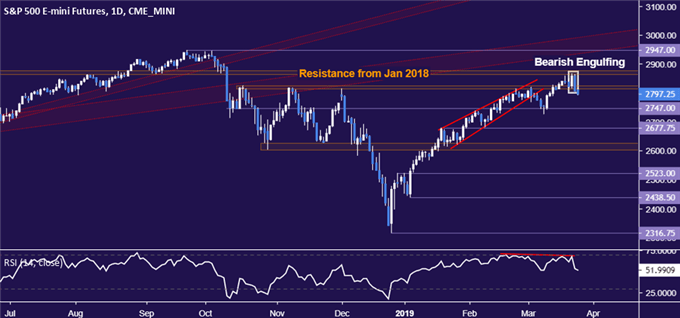

CHART OF THE DAY – S&P 500 CHART SIGNALS RISK AVERSION AHEAD

Signs of topping in the S&P 500 stock index – a proxy for market-wide sentiment trends – hint at potent wave of de-risking on the horizon. The index put in a dramatic-looking Bearish Engulfing candlestick pattern and invalidated an earlier push above then-resistance in the 2814-25 area. Negative RSI divergence points to ebbing upside momentum, bolstering the case for a downside scenario.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter