TALKING POINTS – AUSSIE DOLLAR, YEN, US DOLLAR, STOCKS

- Aussie and NZ Dollars rise as APAC stocks follow Wall Street higher

- S&P 500 futures point higher, spelling trouble for Yen and US Dollar

- GBP/USD technical positioning hints that a top may be taking shape

The sentiment-linked Australian and New Zealand Dollars rose alongside stocks as sentiment brightened in Asia Pacific trade. The anti-risk Japanese Yen and US Dollar dutifully declined. A positive lead from Wall Street seems to be the catalyst at work.

The markets may be forgiven a degree of optimism. The possibility that Brexit will be delayed is now higher after last week’s voting marathon. China’s official Xinhua news agency claimed “concrete progress” has been made on a US-China trade deal. The Fed is due to lower official rate hike bets this week.

All this in the absence of top-tier scheduled event risk that might have derailed momentum could add up to cautious risk-on follow-through. Indeed, bellwether S&P 500 futures are pointing higher to hint that APAC-session price dynamics have scope to extend, at least in the near term.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

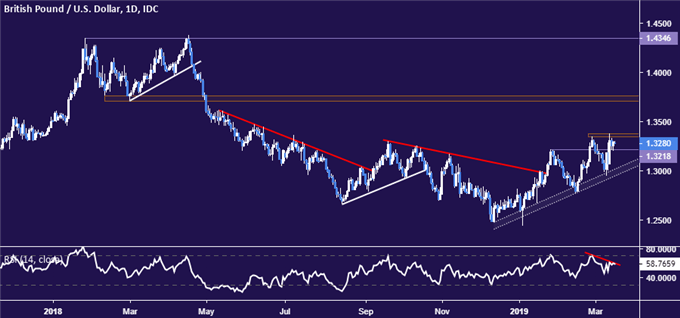

CHART OF THE DAY – GBP/USD MAY BE TOPPING

The British Pound may be starting to show signs of topping. The currency touched a 9-month high against the US Dollar last week but negative RSI divergence hints at ebbing upside momentum, which may precede reversal. Traders might look for confirmation on a daily close below the rising trend line guiding the latest from mid-December lows – now at 1.2956 – for an actionable short trade setup.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter