TALKING POINTS – US DOLLAR, PAKISTAN, INDIA, FED, POWELL, YEN

- Japanese Yen up, Aussie Dollar down as India and Pakistan clash

- S&P 500 futures send risk-off signal, Fed’s Powell to testify again

- US Dollar may rise on neutral policy guidance, souring sentiment

Geopolitical worries struck financial markets in the closing hours of an otherwise quiet Asia Pacific trading session amid reports that Pakistan downed two Indian fighter jets and captured a pilot. The anti-risk Japanese Yen soared, the sentiment-linked Australian Dollar fell and S&P 500 futures – a proxy for the prevailing mood around global financial markets – demonstratively plunged.

US DOLLAR MAY REVERSE DROP ON NEUTRAL POWELL COMMENTS

This sudden spasm comes as markets prepare for Day 2 of Congressional testimony from Fed Chair Jerome Powell. Having presented himself before the Senate yesterday, he is now due at the House of Representatives. While the prepared remarks ought to be nearly identical to what investors have already heard, the follow-on Q&A session might generate some market-moving headlines.

Powell offered familiar “wait-and-see” rhetoric yesterday. He cited global uncertainties and favorable domestic conditions – solid growth and anchored inflation expectations – as reasons for patience before taking the next policy step. The US Dollar fell as soundbites from the testimony hit the wires, but underlying policy bets implied in Fed Funds futures were little-changed.

That tarnishes the case for follow-through and might make the move particularly vulnerable to reversal if Mr Powell lets slip something that clashes with the markets’ demonstrably more dovish view. Indeed, a rate cut is already priced in for 2020. That might boost the Greenback, especially if support is reinforced by any haven demand touched off amid the broader risk-off environment.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

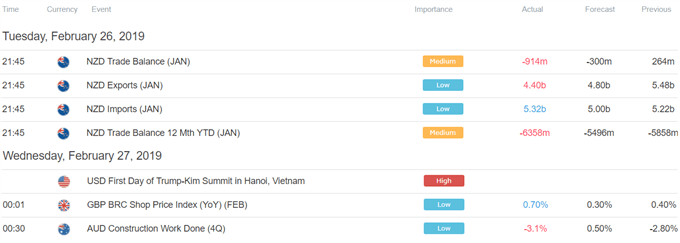

ASIA PACIFIC TRADING SESSION

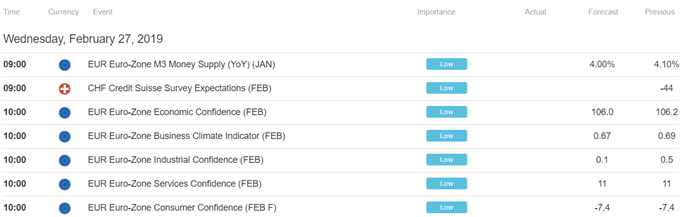

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter