TALKING POINTS – US DOLLAR, YEN, FED, DURABLE GOODS, FACTORY ORDERS

- US durable goods, factory orders data may shape Fed policy outlook

- Outcomes topping analysts’ expectations may drive US Dollar gains

- Yen may rise on fears upbeat data might cut short Fed’s dovish pivot

A lackluster offering on the European economic data docket is likely to put US durable goods and factory orders statistics in the spotlight. While these figures are somewhat dated having been delayed by the US government shutdown, they may be market-moving all the same as investors try to rebuild robust models of the business cycle in the world’s largest economy.

Both metrics are expected to show improvement in November relative to the prior month. US news-flow has steadily improved relative to baseline forecasts in recent weeks, hinting that analysts’ baseline world view is more pessimistic than reality has validated. That opens the door for today’s releases to deliver results that are even rosier than projected.

If Friday’s response to outperforming US economic data is telling, strong outcomes on today’s releases have scope to buoy the US Dollar as the priced-in outlook for the 2019 monetary policy trajectory adjusts to a less dovish setting. That prospect has also proved to be damaging for sentiment however, so the anti-risk Japanese Yen may join the Greenback on the upside while pro-risk commodity currencies decline.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

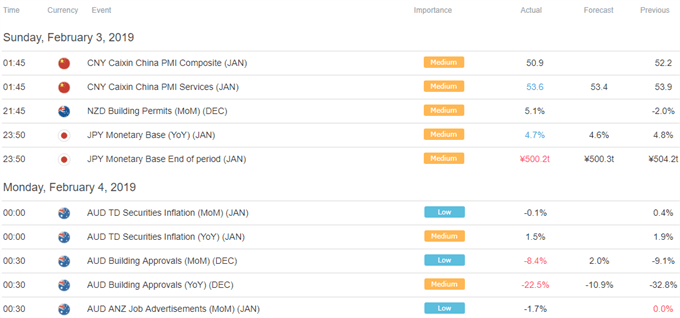

ASIA PACIFIC TRADING SESSION

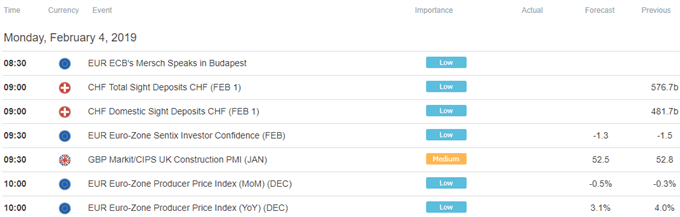

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter