TALKING POINTS – BREXIT, BRITISH POUND, BANK OF ENGLAND, CARNEY

- BOE’s Brexit analysis, FSR report may weigh on the British Pound

- Yen down, Aussie and NZ Dollars up on hopeful G20 summit outlook

- Canadian Dollar lower with local yields as BOC rate hike bets cool

The Bank of England is in focus in European trading hours. It will publish its Financial Stability Report (FSR), which will include stress test result for major UK lenders. The central bank’s analysis of the economic impact of a range of Brexit scenarios is also on offer. Governor Mark Carney will hold a press conference to explain the content on offer.

These updates come at a critical time as UK Prime Minister Theresa May struggles to rally support for the Brexit deal she negotiated with Brussels. Parliament will vote on her proposal on December 11. If it fails, there is almost certainly insufficient time to craft a replacement by a March 29 deadline, opening the door for a “no-deal” rupture.

With that in mind, a credible assessment of Ms May’s proposal relative to its alternatives as well as the resilience of the UK financial system in the event that whatever outcome rattles markets may prove pivotal. A similar work-up from a group of prominent think tank economists rattled markets yesterday. If the central bank’s view is similarly sobering, the British Pound seems likely to suffer.

YEN DOWN, AUSSIE DOLLAR UP ON HOPEFUL G20 OUTLOOK

A cautiously risk-on mood prevailed in Asia Pacific trade. The Australian and New Zealand Dollars rose alongside local shares while the anti-risk Japanese Yen tracked lower. Hopes for de-escalation of the trade war between the US and China after presidents Trump and Xi meet on the sidelines of a G20 gathering this weekend still seem to be buoying investors’ mood.

The Canadian Dollar continued to fall, building on losses in the prior session. The decline echoed a drop in local bond yields, hinting that a dovish shift in BOC policy bets may be the culprit. Indeed the priced-in probability of a rate hike in January fell to the lowest in a month, although trades still see the odds of an increase as better than even at 68.5 percent.

See our free guide to learn how to use economic news in your trading strategy !

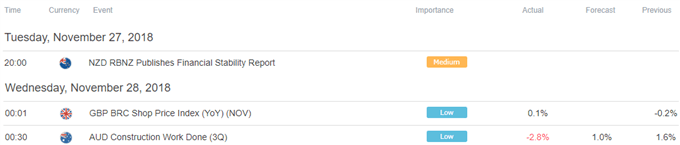

ASIA PACIFIC TRADING SESSION

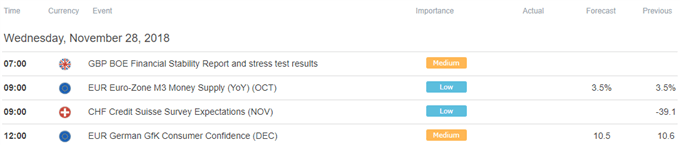

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter