TALKING POINTS – US DOLLAR, YEN, MIDTERM ELECTION, STOCKS, TRUMP

- US Dollar might gain as the Yen falls after midterm elections

- British Pound up as Times article hints at Brexit breakthrough

- Aussie and NZ Dollars rise with stocks in risk-on APAC trade

A quiet day on the economic data docket puts the spotlight on the outcome of midterm elections in the US. Baseline projections derived from polling data and implied in betting markets envision a divided Congress after the votes are counted, with Democrats reclaiming control of the House of Representatives while the Republicans retain a majority in the Senate.

That may derail all but one of President Donald Trump’s major legislative initiative still pending – an infrastructure spending package. Such a plan would amount to a burst of fiscal stimulus, boosting growth as well as inflation and pushing the Fed to raise interest rates faster. Bets on this outcome may drive the US Dollar higher while the Japanese Yen falls as risk appetite improves.

A successful defense of the Republican control of the both Congressional chambers may be seen as endorsing Mr Trump’s more bellicose positions – notably, the trade war with China – and translate into risk-off trade dynamics at the outset. The possibility that a humbled Democratic Party may then be more willing to compromise on common interests like infrastructure spending might cut such moves short however.

Finally, worries about on-coming political volatility may swell in the seemingly unlikely event that Democrats manage to secure control of the Senate and the House. Speculation about how they might deploy their newfound influence to push back against the White House may inspire a protective exodus from USD-denominated assets, sending the benchmark unit lower (at least as a short-term response).

BRITISH POUND GAINS AS BREXIT DEAL HOPES BUILD

The British Pound continued higher in Asia Pacific trade after the Times reported that the EU may be set to endorse UK Prime Minister Theresa May’s proposal on dealing with a post-Brexit border bisecting the island of Ireland. Meanwhile, the Yen fell while the sentiment-linked Australian and New Zealand Dollars rose alongside stocks. The move may have been corrective after yesterday’s selloff.

See our free guide to learn how to use economic news in your trading strategy !

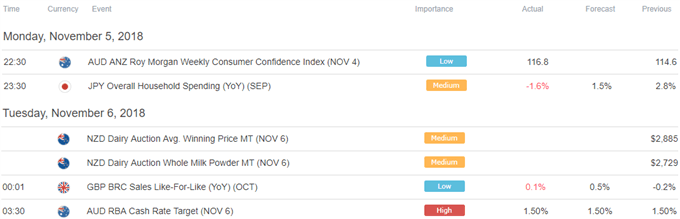

ASIA PACIFIC TRADING SESSION

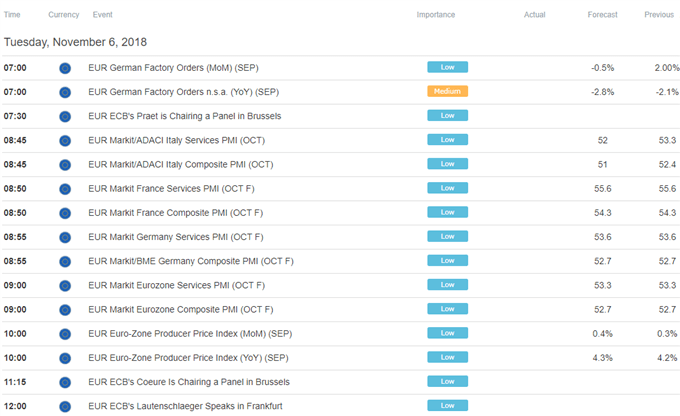

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter