TALKING POINTS – YEN, CANADIAN DOLLAR, FED, STOCKS

- Japanese Yen may continue to retreat as markets’ risk appetite recovers

- Canadian Dollar higher as crude oil prices rebound with stock futures

- Sentiment rebound likely corrective, may not find lasting follow-through

The anti-risk Japanese Yen traded broadly lower in otherwise inconclusive Asia Pacific trade, reflecting a rebound on regional bourses after yesterday’s bloodletting. The Canadian Dollar edged higher, echoing a tepid recovery in crude oil prices amid the broadly risk-on mood. The rest of the G10 FX space showed little conviction, with prices oscillating near levels set at the close of the North American session.

YEN MAY FALL FURTHER BUT FOLLOW-THROUGH SUSPECT

Looking ahead, a quiet offering on the European economic calendar seems likely to keep sentiment trends in the spotlight. FTSE 100 and S&P 500 stock index futures are tracking sharply higher before the opening bell rings in London and New York, hinting that the recovery in sentiment has scope to continue. An expected uptick in the University of Michigan gauge of US consumer confidence may help.

Importantly, none of the issues that led the past 48 hours of breakneck volatility have been resolved or even addressed from a policy perspective. Markets continue to price in a better-than-even chance of a December Fed rate hike and envision at least two further increases in 2019 (although the likelihood of a third one has been marked down a bit). That leaves the apparent impetus for the selloff essentially intact.

With that in mind, any on-coming risk recovery might mean little more than a correction. Indeed, traders are probably keen to unwind any shorter-term risk-off exposure, preferring to avoid any pronounced skew in portfolios ahead of the weekend lull. To that end, follow-through on today’s price action is probably too much to reasonably ask for.

See our forecasts for currencies, commodities and equities to learn what will drive prices in Q4!

ASIA PACIFIC TRADING SESSION

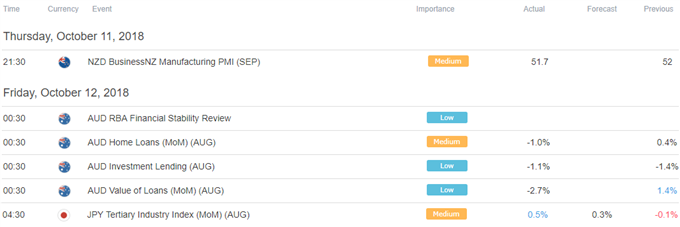

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter