TALKING POINTS – EURO, ECB, BRITISH POUND, BOE, US DOLLAR, CPI

- Euro may decline as ECB downgrades official economic forecasts

- Pound might rise absent unanimous MPC vote to keep rates steady

- US Dollar to return on offense if CPI echoes wage inflation uptick

All eyes are on policy announcements from the European Central Bank and the Bank of England in European trading hours. No changes are expected from either monetary authority but volatility emerge all the same as markets digest the forward guidance on offer.

The ECB seems to be on autopilot through year-end as it winds down QE asset purchases. That makes the timing of the first rate hike thereafter the main object of speculation. Officials have previously winked approvingly at market pricing suggesting an increase no sooner than September 2019.

An updated set of official forecasts may alter investors’ calculus. Economic performance has stabilized since the drop-off in the first half of the year but re-acceleration has not materialized. If this inspires the central bank to downgrade its projections, the Euro may face selling pressure.

For its part, the BOE has sent conflicting signals. Its latest Quarterly Inflation Report signaled Brexit uncertainty will keep tightening timid even as the economy improves. Governor Carney then testified that hikes may come even in a ‘no-deal’ Brexit scenario, striking a more hawkish tone.

Investors may thus look to the vote tally on the rate-setting MPC committee for quantifying clarity. Anything less than unanimous decision in favor of the status quo may be interpreted as relatively somewhat hawkish, sending the British Pound higher. As it stands, markets don’t envision another hike until mid-2019.

Later in the day, the spotlight turns to US CPI data. A downtick in the headline on-year inflation rate is expected but an unexpected jump in wage growth may foreshadow an upside surprise. In this case, a hawkish adjustment in the prevailing Fed policy outlook may put the US Dollar back on the offensive.

See our free guide to learn how to use economic news in your trading strategy !

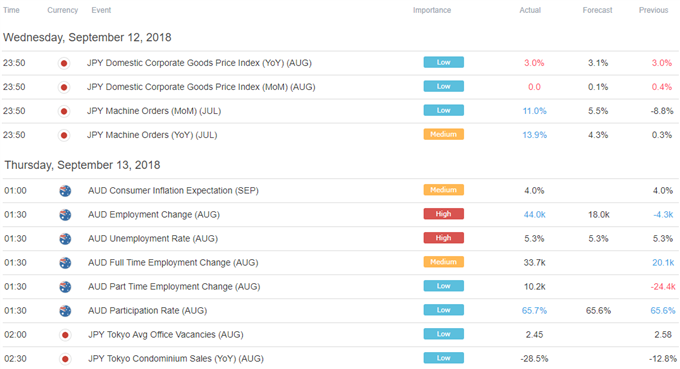

ASIA PACIFIC TRADING SESSION

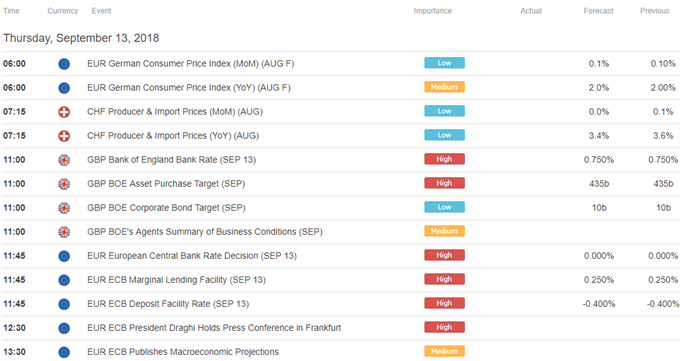

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter