TALKING POINTS – US DOLLAR, POWELL, JACKSON HOLE, AUSTRALIAN DOLLAR

- US Dollar may rise as Fed Chair Powell talks up rate hikes

- Aussie Dollar gains after Morrison replaces Turnbull as PM

- Yen down, NZ Dollar up as risk appetite firms in APAC trade

A dull offering of European economic data is likely to see traders singularly focused on a speech from Fed Chair Jerome Powell at the US central bank’s Economic Symposium in Jackson Hole, Wyoming. Such appearances have frequently marked the announcement of key forward guidance establishing the monetary policy trajectory for the months ahead.

Mr Powell will probably look to make the case for continued interest rate hikes. Rhetoric asserting the Fed’s independence may be aimed at countering dovish jawboning from the White House while the priority of domestic objectives is stressed to deflect worries about cross-border spillover. Some emerging markets – most recently, Turkey – have wobbled as the Fed’s actions boost global borrowing costs.

The US Dollar is likely to rise in this scenario as the likelihood of a fourth rate increase in 2018 rises. Markets currently peg the probability of such an outcome at 66 percent, leaving room for greater conviction to be reflected in asset prices. Signaling that the policy stance may not be labeled “accommodative” for much longer might imply the end of the rate hike cycle is in sight however, cooling the bulls’ enthusiasm.

The Australian Dollar rose in Asia Pacific hours as the country’s government settled on who will be Prime Minister, ending days of uncertainty. The embattled Malcolm Turnbull will exit the top post, to be replaced by heretofore Treasurer Scott Morrison. The move represents a kind of hold at status quo relative to the elevation of Peter Dutton, who fronted the effort to challenge Turnbull from the right.

Resolution in Canberra seemed to buoy risk appetite across regional bourses. Shares edged up and the sentiment-geared New Zealand Dollar followed its Aussie counterpart upward. The Japanese Yen tellingly declined alongside Treasury bonds, pointing to capital flows out of anti-risk and safe haven alternatives. The greenback pulled back in the meanwhile as markets digested yesterday’s spirited advance.

See our free guide to learn how to use economic news in your trading strategy !

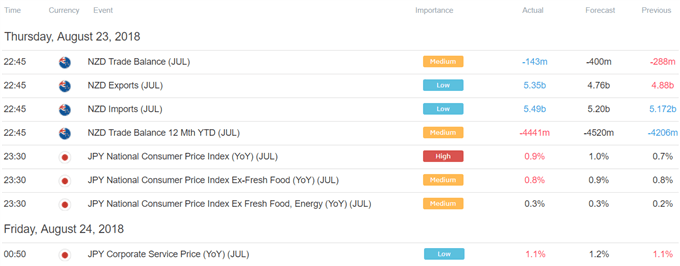

ASIA PACIFIC TRADING SESSION

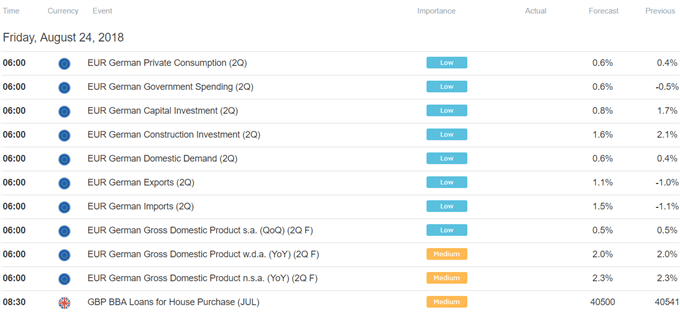

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter