TALKING POINTS – TRADE WAR, FED, SENTIMENT, STOCKS, US DOLLAR

- Currency markets left looking to conflicted sentiment trends for direction

- Sensitivity to headline risk may be elevated, trade war narrative in focus

- Hawkish Fed-speak might boost rate hike outlook, drive US Dollar higher

An empty economic calendar in European trading hours leaves markets with relatively little besides risk appetite trends to direct near-term price action. Where sentiment might lead is itself clouded however, with futures tracking the FTSE 100 and S&P 500 equity benchmarks trading conspicuously flat before markets in London and New York come online.

That may translate into a consolidate session, with baseline assets confined to recent ranges until fresh fodder comes across the wires. It may also make for increased sensitivity to stray headline flow however as markets search for a catalyst. Soundbites informing lingering concerns about global trade war escalation might prove particularly potent.

Scheduled remarks from hawkish-leaning Richmond Fed President Tom Barkin might be another source of volatility in the absence of higher-profile developments. The priced-in probability of a fourth interest rate hike in 2018 has increased to 68.7 percent, up from 62.1 percent a week ago. A confident tone from Mr Barkin might encourage greater conviction still, boosting the US Dollar.

See our free guide to learn how to use economic news in your trading strategy !

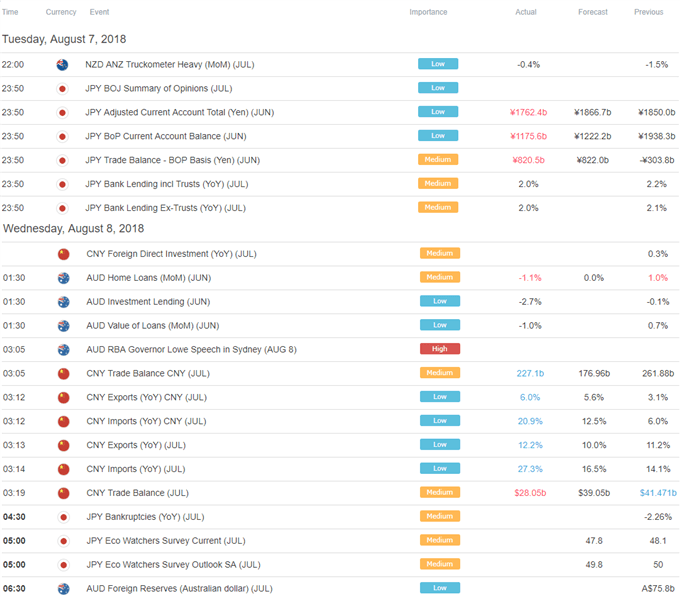

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

No data.

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter