TALKING POINTS – AUSSIE & NZ DOLLARS, ASIA STOCKS, FED RATES OUTLOOK

- Aussie, NZ Dollars follow AsiaPac stocks lower on Fed rate hike fears

- Pound down on cautious Carney comments, Yen digesting earlier rise

- Hawkish remarks from Fed’s Evans may continue US Dollar recovery

Asia Pacific markets picked up on a negative lead from Wall Street, where worries about Fed rate hike acceleration weighed on risk appetite. Regional shares shed nearly 1 percent on average, with losses tracked by the sentiment-linked Australian and New Zealand Dollars.

The typically anti-risk Japanese Yen put in a mixed performance as prices digested yesterday’s gains. The US Dollar continued to advance having been emboldened by a steepening of the priced-in 2019 tightening path and the largest jump in the spread between 10- and 2-year Treasury bond yields in two months.

Rate hike bets swelled after usually dovish Fed Governor Lael Brainard offered an ominous speech warning of looming “cyclical pressures” – seemingly a byword for inflation – and worried aloud about stretched asset prices and business leverage levels. Price rise signals in the Philly Fed survey also helped.

The British Pound continued to lose ground having suffered outsized losses yesterday after BOE Governor Mark Carney cooled near-term rate hike bets. He said a few hikes are likely in the coming years but seemingly downplayed the likelihood of a May increase, which markets assign a 70 percent probability.

Looking ahead, a quiet European data docket is likely to keep Fed-speak in focus. Comments from Chicago Fed President Charles Evans – another dove – are on tap. If he follow’s Governor Brainard’s hawkish pivot, a repeat of yesterday’s price dynamics may be in store.

See our quarterly FX market forecast s to learn what will drive prices through mid-year!

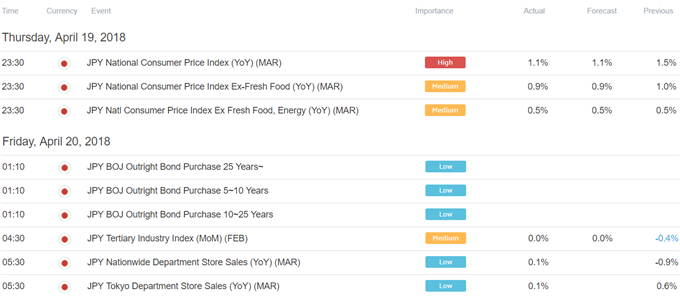

Asia Pacific Trading Session

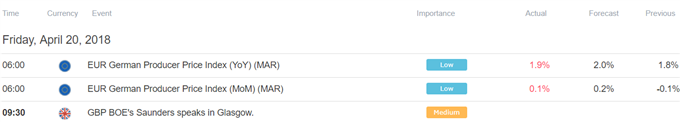

European Trading Session

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE