TALKING POINTS – UK INFLATION, CHINA RRR CUT, FED BEIGE BOOK

- British Pound may fall if disappointing UK CPI trims BOE rate hike bets

- US Dollar looks to Fed Beige Book, eyeing clues of steeper tightening path

- Yen down as China RRR cut helps boost risk appetite in Asia Pacific trade

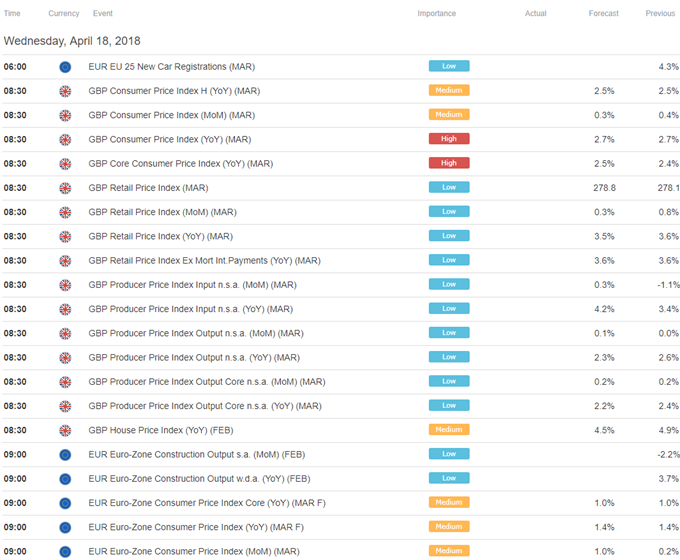

March’s UK CPI report headlines the economic calendar in European trading hours. The headline inflation rate is expected to register at 2.7 on-year, unchanged from the prior month. The core rate excluding volatile items to measure underlying price growth trends is seen ticking up to 2.5 percent however after dropping to a seven-month low in February.

UK economic data outcomes have increasingly underperformed relative to consensus forecasts in recent months, warning that analysts’ models may be overly rosy and opening the door for another downside surprise. Such a result may clash with a recent build in priced-in BOE rate hike expectations, cooling bets on a near-term increase and sending the British Pound lower.

Later in the day, the Fed Beige Book survey of regional economic conditions comes into the spotlight. An upbeat tone echoing optimism on display in recent comments from central bank officials may inspire a steepening of the expected policy tightening path, pulling the US Dollar upward. As it stands, markets have accounted for three hikes this year and put the probability of a fourth at 30.8 percent.

The Japanese Yen underperformed in Asia Pacific trade as regional shares advanced, sapping the appeal of the standby anti-risk currency. The benchmark MSCI APAC equity index added 0.5 percent. A positive lead from Wall Street was reinforced as the PBOC unexpectedly cut reserve requirements for a range of Chinese banks by 1 percent, easing worries about tightening monetary conditions.

See our quarterly FX forecast s to learn what will drive prices through mid-year!

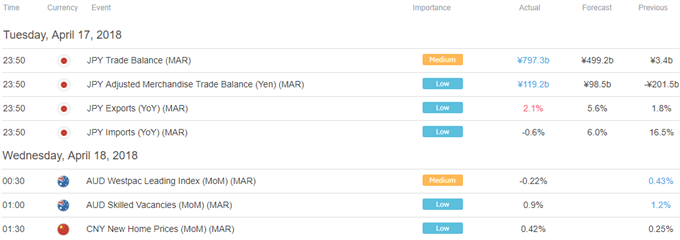

Asia Pacific Trading Session

European Trading Session

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE