Talking Points:

- British Pound gains on hopes for post-Brexit Irish border deal

- Regional haven Franc down but broader risk-off mood remains

- US/China trade war concerns continue to undermine sentiment

The British Pound is soaring in early European trade amid reports that a solution to the post-Brexit fate of the border between the Republic of Ireland – an EU member state – and Northern Ireland. A Times report alleged that Irish officials were told to expect the “imminent” announcement of a new UK plan for avoiding a “hard” frontier between the two sides.

Regional anti-risk standby the Swiss Franc is trading broadly lower on the news. The similarly-profiled Japanese Yen is also under pressure, although to a lesser extent. The latter currency’s tepid response may reflect an otherwise “risk-off” mood across financial markets. European shares are following Asia Pacific bourses lower and S&P 500 futures hint at more of the same when Wall Street comes online.

Sentiment-geared commodity bloc currencies are duly pressured, with the New Zealand Dollar leading the way downward. As the highest yielder of the bunch, it may also be the most vulnerable to liquidation as carry-seeking exposure is unwound. The US Dollar appears to have found a haven bid, rising even as an exodus from risky assets boosts bonds and thereby pressures Treasury yields downward.

Technology shares are suffering the lion’s share of losses on European exchanges, echoing similar performance in New York yesterday and in Asian trade today. That follows reports that the Trump administration may be planning to crack down on Chinese investment in the sector. Treasury Secretary Mnuchin’s attempt at restoring calm credited with Monday’s rosy outturn seems like a distant memory.

Looking ahead, a revised set of fourth-quarter US GDP figures headlines the economic data docket. An upgrade is expected, but this may be brushed aside as too stale to meaningfully offset near-term angst. Indeed, it would be difficult to extrapolate a favorable outlook from even a very firm set result considering it would not account for trade-related headwinds emerging after the calendar turned to 2018.

Get our guide to learn how you can use economic news into your FX trading strategy !

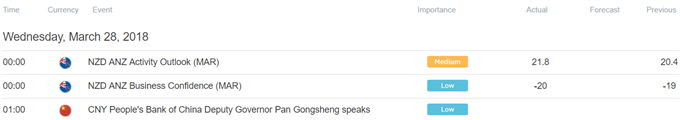

Asia Pacific Trading Session

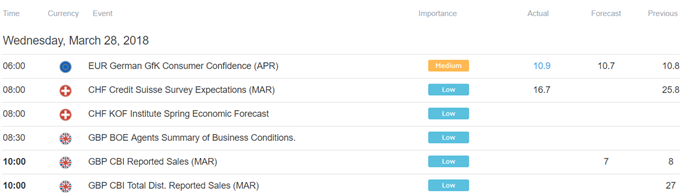

European Trading Session

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE