Talking Points:

- US Dollar extending Friday’s drop after wage growth data disappoints

- Aussie, NZ Dollars rise as worries about steep Fed hike path dissipate

- Japanese Yen may decline as risk appetite improves across the markets

The US Dollar traded broadly lower in Asia Pacific trade are regional markets took their turn responding to last week’s release of official employment data for February. Perhaps most notably, the report showed that US wage inflation fell short of expectations, hinting that the prior month’s surge might have been a one-off. That cooled worries about a steeper Fed rate hike cycle than the markets have accounted for.

Beyond the greenback, ebbing concerns about aggressive stimulus withdrawal have buoyed risk appetite. The MSCI Asia Pacific equities benchmark has added over 1 percent, echoing Friday’s rosy outing on Wall Street. Not surprisingly, sentiment-geared currencies like the Australian and New Zealand Dollars are following shares higher, with the higher-yielding Kiwi tellingly leading the way.

Looking ahead, a lackluster offering of European and US scheduled event risk may keep risk appetite trends at the forefront. Futures tracking the FTSE 100 and S&P 500 stock indexes are pointing convincingly higher before London and New York come online, hinting that established trade patterns may continue to find follow-through. That may translate into weakness for the heretofore resilient Yen before the day is through.

Get help building confidence in your FX trading strategy with our free guide!

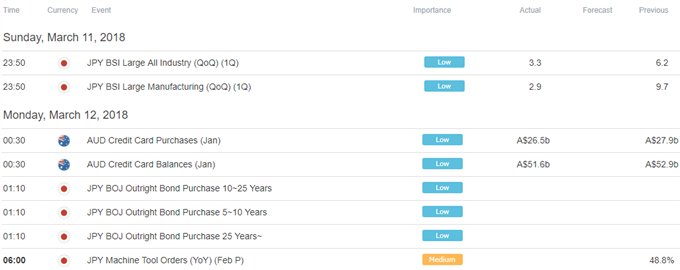

Asia Pacific Trading Session

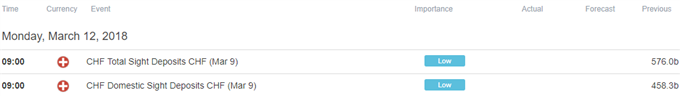

European Trading Session

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE