Talking Points:

- Yen gains, commodity currencies drop on renewed trade war jitters

- Euro unlikely to find follow-through in revised Eurozone GDP data

- Stock index futures down, hinting risk aversion is likely to continue

The Japanese Yen outperformed in Asia Pacific hours as trade war jitters darkened the markets’ mood anew, sending regional stocks lower and offering a lift to the standby anti-risk currency. The similarly-minded Swiss Franc also rose. Sentiment-geared commodity bloc currencies bore the brunt of selling pressure.

The Australian Dollar saw losses amplified by disappointing local GDP data. The Canadian Dollar competed vigorously for the dubious honor of the day’s weakest G10 FX unit. Sheer proximity to the US seems to have become a liability as the tone of the Trump administration turns increasingly protectionist.

Looking ahead, the European data docket offers little that might inspire fireworks. The final revision of fourth-quarter Eurozone GDP figures will cross the wires. Absent a major deviation from earlier estimates, the Euro seems likely to look past the outcome, focusing on the upcoming ECB policy decision instead.

Absent a potent-enough driver from scheduled event risk, broadly based sentiment trends will probably remain at the forefront. Futures tracking the benchmark S&P 500 stock index are pointing sharply lower, hinting that a “risk-off” mood is likely to prevail as day wears on.

Investors’ heightened headline sensitivity ought to be kept in mind however. A mere comment from US House of Representatives Speaker Paul Ryan opposing Trump-back tariffs was apparently sufficient to throw markets back into “risk-on” mode yesterday. Something similar may yet transpire in coming hours.

See our free guide to learn how to use economic news in your trading strategy !

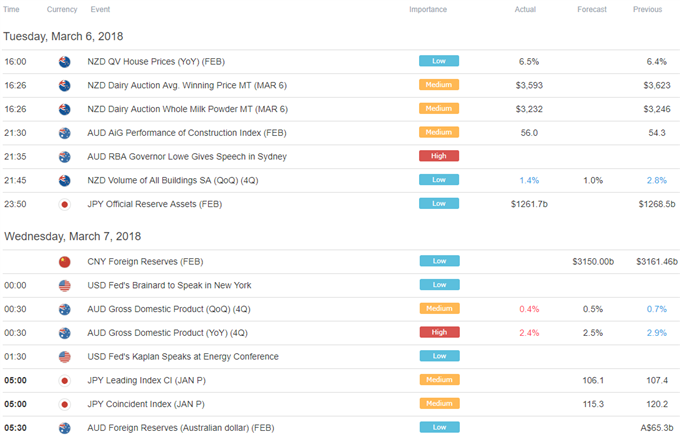

Asia Pacific Trading Session

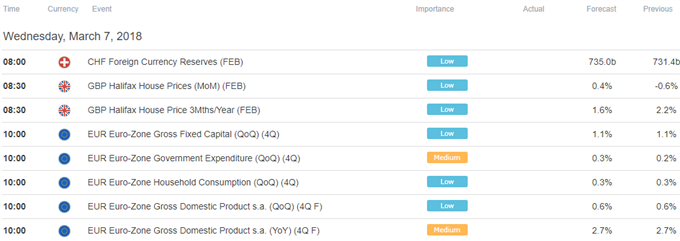

European Trading Session

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE